Does the thought of financial statements make you sweat? 😰 For many founders, terms like “assets,” “liabilities,” and “equity” feel like a foreign language designed to be confusing. The pressure to build a business plan and face investors without a clear financial picture is real. Staring at a blank spreadsheet feels impossible. But what if you could understand the most important financial snapshot—the balance sheet—in just a few minutes? What if it wasn’t complicated at all?

This guide is your shortcut. We cut through the jargon to deliver a simple, fast explanation of what a balance sheet shows and why it’s crucial for proving your company’s health. You’ll learn how to read one instantly, see exactly what investors are looking for, and discover how to create a professional version for your business plan—without the weeks of stress. Get ready to turn financial confusion into total confidence. ✓

What Is a Balance Sheet? The Core Idea in 60 Seconds

Think of a balance sheet as a financial snapshot. 📸 It’s a single picture showing your company’s exact financial health on a specific day. If you have a personal net worth statement, you already get the core idea—this is the business version. It cuts through the noise and gives you a clear, instant summary of where you stand.

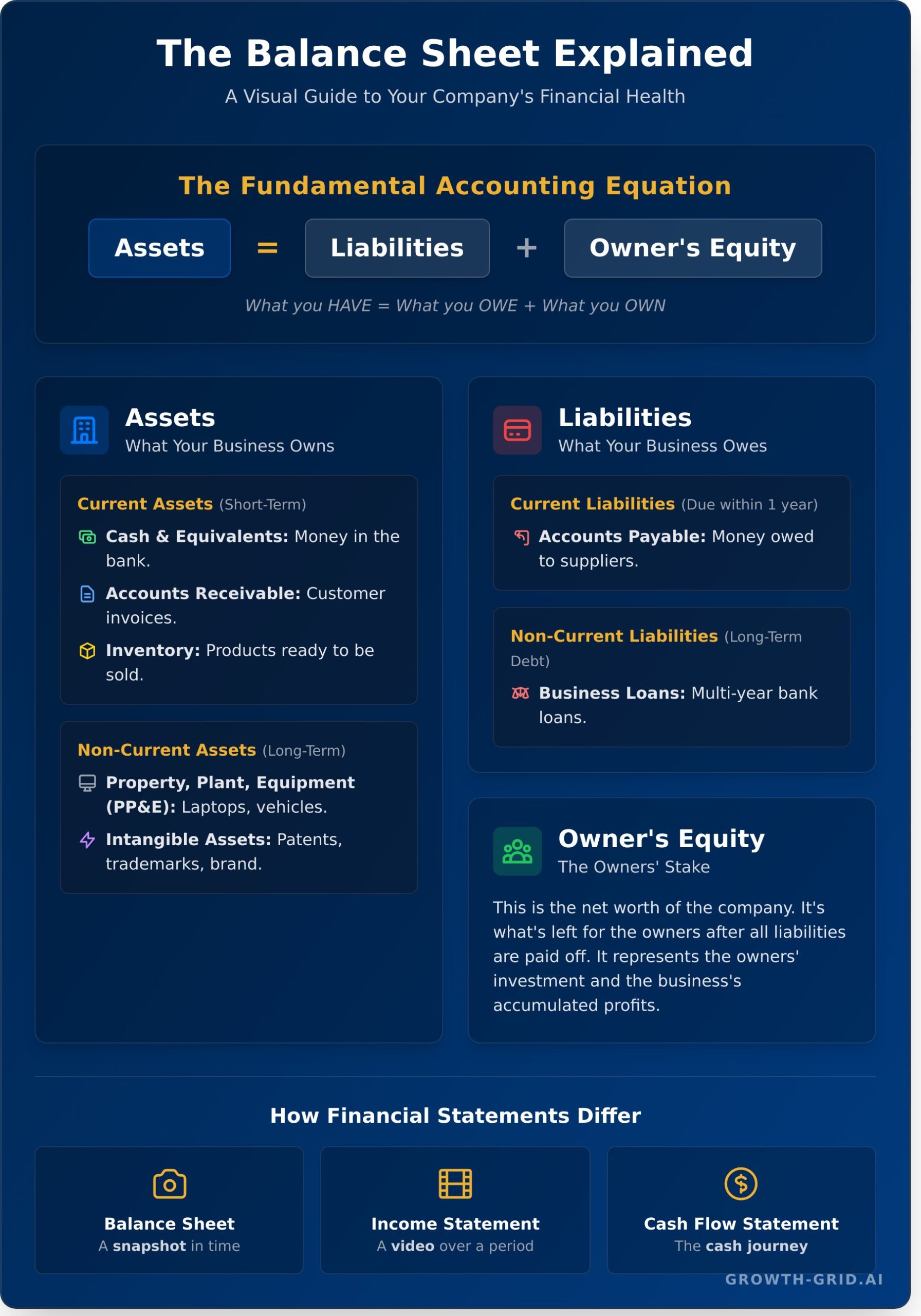

Everything boils down to one simple, powerful formula: the accounting equation. This is the bedrock of the modern balance sheet and the key to understanding your company’s structure.

Assets = Liabilities + Owner’s Equity

In plain English, this means: What Your Business Has = What It Owes + What You Truly Own. The two sides of this equation must always be equal. If they aren’t, something is wrong. That’s why it’s called a “balance” sheet—it has to balance. Every single time.

Why It’s a Non-Negotiable Part of Your Business Plan

A balance sheet isn’t just for accountants; it’s a powerful tool for growth. It validates your business model and gives you the clarity to make winning decisions.

- Prove Your Viability: Investors and lenders look here first. A strong balance sheet is your ticket to getting funded.

- Make Smarter Decisions: Instantly see if you can afford to take on debt, invest in new equipment, or expand your team.

- Track Your Progress: Compare snapshots over time (e.g., quarter over quarter) to measure your financial growth and spot trends fast.

Balance Sheet vs. Income Statement vs. Cash Flow Statement

Don’t get these three key reports confused. Here’s the fastest way to tell them apart:

- Balance Sheet: A snapshot in time. It shows your financial position on one specific day (e.g., as of December 31, 2023).

- Income Statement: A video over a period. It shows your profitability (revenue and expenses) over a month, quarter, or year.

- Cash Flow Statement: The cash journey. It tracks the actual movement of cash in and out of your business over a period.

Decoding the Components Part 1: Assets (What Your Business Owns)

Think of assets as everything your business owns that has future economic value. They are the resources that help you operate, grow, and generate revenue. On a balance sheet, assets are always listed first and are organized by liquidity—or how quickly and easily they can be converted into cash. Understanding this order is a crucial first step in mastering How to Read a Balance Sheet and getting a clear picture of your company’s financial health.

Assets are split into two main categories: current and non-current. This simple distinction helps you instantly see your short-term resources versus your long-term foundation.

Current Assets: Your Short-Term Resources

These are assets that you expect to use, sell, or convert into cash within one year. They are vital for covering your day-to-day operational expenses.

- Cash and Cash Equivalents: This is the most liquid asset. It’s the money in your business bank accounts and any short-term investments that can be converted to cash almost instantly.

- Accounts Receivable: This is the money your customers owe you for goods or services already delivered. Think of it as the total value of your outstanding invoices.

- Inventory: If you sell physical products, this is the value of the goods you have on hand ready to be sold. For a startup coffee shop, this would be coffee beans, cups, and pastries.

- Prepaid Expenses: These are payments you’ve made in advance for future services, like a 12-month insurance policy or an annual software subscription.

Non-Current (or Long-Term) Assets: Your Foundation for Growth

These are the long-term investments you’ve made in your business that you don’t plan on converting to cash within a year. They are the core tools that drive your company’s future growth.

- Property, Plant, and Equipment (PP&E): These are the tangible, physical assets that keep your business running. This includes everything from company laptops and office furniture to delivery vehicles and machinery.

- Intangible Assets: These are valuable resources you can’t physically touch. Common examples include trademarks, patents, copyrights, and the goodwill associated with your brand’s reputation.

- Long-term Investments: This includes any stocks, bonds, or real estate your company owns and intends to hold for more than one year to generate income.

Decoding the Components Part 2: Liabilities & Equity (What You Owe & Own)

If assets are what your business has, liabilities and equity explain how you paid for them. This side of the fundamental accounting equation reveals the financial structure of your company—a mix of borrowed funds (liabilities) and owner investments (equity). Getting this balance right is crucial for sustainable growth.

Think of it this way: every dollar of assets your company owns had to come from somewhere. It was either financed with debt that you have to pay back (a liability) or funded by the owners (equity).

Liabilities: What Your Business Owes

Liabilities are your company’s financial obligations or debts. These are claims that outsiders, like banks or suppliers, have on your assets. Managing them effectively is non-negotiable for long-term stability. They are split into two simple categories based on when they’re due:

- Current Liabilities: These are short-term debts you need to pay back within one year. Think fast-turnaround obligations like accounts payable (what you owe suppliers), outstanding credit card balances, and short-term loans. ✓

- Non-Current Liabilities: These are your long-term financial commitments, due more than a year from now. This category typically includes major funding sources like multi-year business loans, bonds payable, or long-term lease obligations.

Owner’s Equity: The Owners’ Stake

After accounting for all your liabilities, what’s left over belongs to the owners. This is your Owner’s Equity (also called Shareholder’s Equity). It represents the owners’ stake in the company and is a core part of any complete balance sheet. Understanding this concept is fundamental, as detailed in any authoritative guide to balance sheets, because it shows the company’s net worth on paper.

Equity comes from two primary sources:

- Paid-in Capital: This is the cash directly invested into the business by its founders or shareholders in exchange for stock. It’s the foundational money used to get things started and scale up.

- Retained Earnings: This is the powerhouse of organic growth. It represents the cumulative profit your company has earned over time and reinvested back into the business instead of paying it out to owners as dividends.

Together, these components show the “book value” of your company. A healthy, growing equity figure is a powerful sign of a financially sound business that is creating value over time.

How to Read a Balance Sheet: 3 Key Insights for Founders

A balance sheet isn’t just a list of numbers for your accountant. It’s a powerful snapshot of your company’s financial health at a single moment in time. Understanding how to read it means you can answer the tough questions investors and lenders will ask—before they even ask them.

Forget complex accounting jargon. Think of this as a quick, 5-minute health check for your business. Here are three simple ways to analyze your balance sheet and get a clear picture of where you stand.

Insight #1: Do You Have Enough Cash to Survive? (Liquidity)

This is the most critical short-term question every founder must answer. The answer lies in your Current Ratio, a quick calculation that shows if you can cover your upcoming bills and operational expenses.

- The Formula: Current Assets / Current Liabilities

A ratio above 1.0 is a good sign. It means you have more cash and assets that can be quickly converted to cash than you have debts due within the next year. For example, a ratio of 2.0 means you have $2 in assets for every $1 in liabilities. A ratio below 1.0 is a major red flag 🚩, signaling potential cash flow problems that could jeopardize your business.

Insight #2: How Reliant Are You on Debt? (Leverage)

Investors and lenders want to know who has a bigger claim on your assets: you or your creditors? The Debt-to-Equity Ratio gives them a fast, clear answer and reveals how much financial risk your company is taking on.

- The Formula: Total Liabilities / Owner’s Equity

A high ratio indicates that your company is heavily financed by debt, which investors see as high risk. If the business struggles, lenders get paid first. A lower ratio shows that you have more “skin in the game,” making your business a much safer bet. This single number heavily influences your ability to secure future loans or investment.

Insight #3: How Is Your Business Growing Over Time?

A single balance sheet is a snapshot. But comparing several snapshots over time tells a powerful story. Is your business getting financially stronger or weaker? Place your balance sheets from the last three or four quarters side-by-side and look for clear trends.

Positive trends that build a compelling growth story for investors include:

- ✓ Increasing cash reserves: You’re building a bigger safety net.

- ✓ Growing owner’s equity: Your company’s net worth is increasing.

- ✓ Decreasing long-term debt: You’re successfully paying down what you owe.

This historical trend analysis is the foundation for creating credible financial projections in your business plan. It proves your growth isn’t just a guess—it’s a pattern.

Putting It All Together: A Simple Balance Sheet Example

Theory is great, but seeing a balance sheet in action makes everything click. Let’s break down the financial position of a fictional startup, ‘Brew & Code,’ a small coffee shop that also offers a co-working space for local tech professionals. This snapshot shows exactly where the business stands on the last day of the year.

Sample Balance Sheet for ‘Brew & Code’ – As of Dec 31, 2025

Remember the fundamental accounting equation: Assets = Liabilities + Owner’s Equity. Watch how it balances perfectly below.

| Assets (What the Business Owns) | Liabilities & Equity (What the Business Owes) |

|---|---|

Current Assets

Non-Current Assets

|

Liabilities

Owner’s Equity

|

| Total Assets: $20,000 | Total Liabilities & Equity: $20,000 |

Quick Analysis of the Example

A balance sheet isn’t just a list of numbers—it’s a tool for instant financial insight. By calculating a few simple ratios, we can quickly assess the health of ‘Brew & Code’.

- Current Ratio (Liquidity): This measures the ability to pay short-term debts. The formula is Current Assets / Current Liabilities. For Brew & Code, that’s $12,000 / $1,500 = 8.0. A ratio above 1 is good; 8.0 is excellent, showing they have $8 in liquid assets for every $1 of short-term debt. ✓

- Debt-to-Equity Ratio (Leverage): This shows how much the company relies on debt versus owner funding. The formula is Total Liabilities / Total Equity. Here, it’s $10,000 / $10,000 = 1.0. This means for every dollar of equity, there is a dollar of debt—a balanced and manageable risk level for a new business. ✓

Stop stressing over spreadsheets and formulas. Ready to build your own professional financial statements in minutes? Let our AI do the heavy lifting. ✨

How to Create a Balance Sheet: The Hard Way vs. The Smart Way

You understand the components of a balance sheet. Now, how do you actually build one? For modern entrepreneurs, there are two distinct paths: the slow, stressful route and the fast, intelligent one. The choice you make directly impacts your time, your stress levels, and the quality of your final document.

The Hard Way: Manual Spreadsheets

The traditional method involves firing up Excel or Google Sheets and starting from a blank slate. You’ll spend hours hunting down bank statements, loan agreements, and asset values, then painstakingly build formulas to connect everything. The entire process is loaded with risk.

- ✗ Formula Nightmares: 😰 One tiny error in a cell can throw off your entire financial statement, leading to hours of frustrating detective work to find the mistake.

- ✗ Wasted Time: Manually entering data and double-checking every line is a massive time sink. It’s time you should be spending on strategy, not basic accounting.

- ✗ Unprofessional Look: A generic spreadsheet rarely looks polished enough to impress potential investors or lenders who see hundreds of them.

- ✗ Constant Stress: The nagging worry of ensuring your assets perfectly equal your liabilities plus equity is a headache you simply don’t need.

The Smart Way: Using an AI Business Plan Generator

There is a better way. Instead of wrestling with cells and formulas, you can leverage AI to do the heavy lifting instantly. With GrowthGrid, you just answer a series of simple, guided questions about your business—no complex financial jargon required.

Our AI takes your answers and automatically generates your complete financial projections, including a perfect balance sheet.

- ✓ Done in Minutes, Not Days: Get a complete, accurate financial statement without the headache. What used to take a weekend now takes less time than a coffee break.

- ✓ Guaranteed to Balance: Our system ensures the fundamental accounting equation is always correct. No manual calculations, no formula errors. Ever.

- ✓ Investor-Ready Format: We output a professional, clean, and easy-to-read document that builds instant credibility with banks and investors.

Stop wasting time and eliminate the risk of costly errors. Let our AI build your complete, bank-ready business plan for you.

Generate Your Professional Business Plan with AI in 8 Minutes →

From Confused to Confident: Master Your Financials

You’ve successfully decoded the financial snapshot of your business. The balance sheet is no longer a source of confusion, but a tool for clarity. Remember the key takeaways: it’s a direct reflection of your company’s health at a single point in time, and it’s all governed by the simple, powerful formula: Assets = Liabilities + Equity. Mastering this gives you the confidence to steer your startup toward growth.

Understanding your financials is a huge step. Now, let’s create them—the smart way. Forget the stress of manual spreadsheets and expensive consultants. GrowthGrid’s AI instantly generates your complete, 72-section business plan, with all the professional financial statements you need. Join thousands of entrepreneurs who trust our platform to build investor-ready plans in minutes. We’re so confident you’ll succeed, we back it with a 100% Satisfaction Guarantee.

Generate your professional business plan and financials in minutes.

Your brilliant idea deserves a brilliant plan. Stop waiting and start building today.

Frequently Asked Questions About The Balance Sheet

What is the difference between a balance sheet and an income statement?

Think of it this way: a balance sheet is a photo, while an income statement is a video. The balance sheet provides a snapshot of your company’s financial health on a single day, listing what you own (assets) and what you owe (liabilities). The income statement shows performance over a period—like a month or quarter—by tracking revenue and expenses to calculate your net profit or loss. One shows your position, the other shows your performance.

How often should a small business prepare a balance sheet?

For smart, proactive management, preparing a balance sheet monthly is the gold standard. This gives you a real-time pulse on your business, allowing you to spot trends and fix issues fast. While quarterly reports are the minimum for tax purposes, a monthly schedule empowers you to make data-driven decisions that fuel growth. Don’t wait three months to discover a problem you could have solved in week one.

Can a company have negative owner’s equity? What does that mean?

Yes, and it’s a critical warning sign. Negative owner’s equity means your company’s total liabilities are greater than its total assets—in short, you owe more than you own. This state is often called insolvency. While it can occur in aggressive growth-stage startups taking on significant debt, for an established business, it signals serious financial distress that requires immediate and decisive action to correct.

Why do they call it a ‘balance’ sheet?

It’s not a clever name; it’s a literal one. The report is built on the fundamental accounting equation that must always balance: Assets = Liabilities + Owner’s Equity. This means everything the company owns must be equal to all claims against those assets (from both creditors and owners). If the two sides of the equation don’t add up to the same number, you know there’s an error somewhere in your books. It’s a built-in accuracy check.

Where do I find the numbers to create my first balance sheet?

The numbers come directly from your core business records. Your general ledger is the primary source, which pulls information from your bank statements (for cash), accounts receivable and payable reports, inventory logs, and loan statements. The good news? Modern accounting software like QuickBooks or Xero automates this process, making it fast and easy to generate your first professional balance sheet in minutes, not hours.

Is a balance sheet required to get a small business loan?

Yes, absolutely. Lenders will almost always require a current balance sheet as a core part of your loan application. It gives them an instant, clear snapshot of your company’s net worth and overall financial stability. They use this report to assess risk and determine if your business is a sound investment. Arriving with an accurate, well-organized balance sheet shows you are a serious and prepared business owner.