Staring at a blank page, feeling overwhelmed by the thought of creating a small business plan outline? 😰 You’re not alone. The fear of missing a critical section for investors, getting lost in confusing financial projections, or simply not knowing where to start can be paralyzing. It feels like a mountain of work standing between your brilliant idea and its launch.

Stop the stress and forget the guesswork. This guide is your step-by-step roadmap to get it done-fast. We’re giving you a comprehensive, section-by-section breakdown of a traditional business plan that gets results. We’ll show you exactly what to include in every part, from a powerful executive summary to the detailed financial appendix, so you can confidently build a professional plan.

By the end, you’ll have a finished document that helps you secure funding, attract partners, and guide your new business to success. Let’s turn that overwhelming task into your biggest asset. →

Key Takeaways

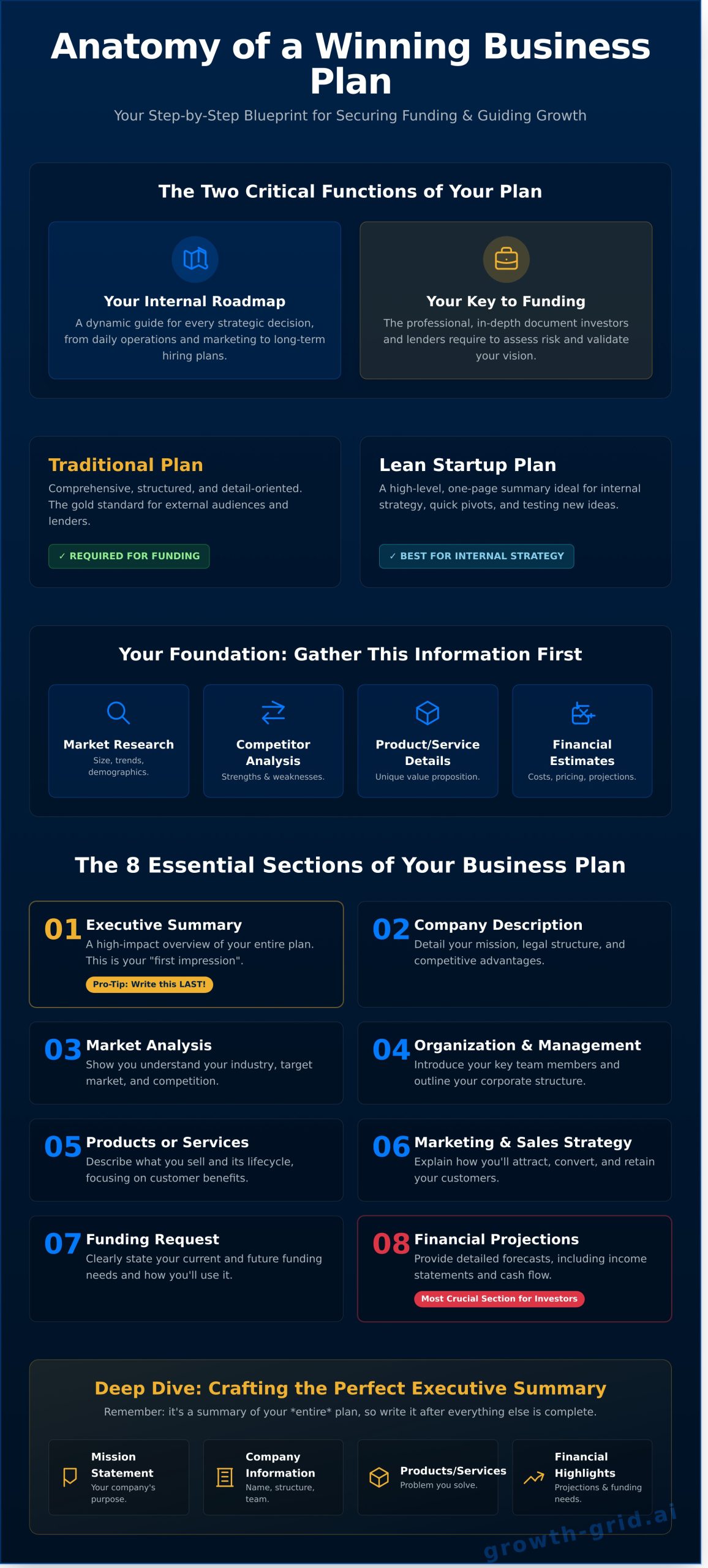

- Understand that a business plan serves two critical functions: securing funding from investors and acting as your internal roadmap for success.

- Master the 8 essential sections of a professional small business plan outline, from your company description to your sales strategy.

- Learn the pro-level secret to crafting a powerful Executive Summary by writing it *after* you’ve completed every other section of your plan.

- Tackle the most crucial section with confidence by learning what investors and lenders actually need to see in your financial projections.

Why a Solid Outline is Your Business’s Blueprint for Success

Let’s be honest: the thought of writing a business plan can feel overwhelming. 😰 But think of it less as a 40-page homework assignment and more as your company’s blueprint for success. A great business plan is a dynamic tool that serves two critical functions. First, it’s your internal roadmap, guiding every strategic decision from marketing to hiring. Second, it’s the professional document you absolutely need to secure funding from investors or a loan from a bank.

The secret to tackling this task without the stress is starting with a solid small business plan outline. It transforms an intimidating project into a series of simple, actionable steps. This guide focuses on the detailed, traditional outline that serious funders expect to see.

Traditional vs. Lean Startup Plan: Which Do You Need?

You have two main options, and choosing the right one saves you time. A traditional business plan is comprehensive, structured, and detail-oriented. It’s the standard for external audiences because it gives investors and lenders the in-depth information they need to assess risk and verify your vision. In contrast, a lean startup plan is a high-level, often one-page summary perfect for internal strategy, quick pivots, and testing ideas. While useful, it simply lacks the detail required for a loan application. For funding, the traditional plan is non-negotiable.

Before You Write: Key Information to Gather

You wouldn’t build a house without laying the foundation first. The same goes for your business plan. Gathering key data beforehand makes the writing process 10x smoother and faster, turning a marathon into a series of sprints. Before you start writing, pull together:

- Market & Industry Research: Size, trends, and customer demographics.

- Competitor Analysis: Who they are, their strengths, and their weaknesses.

- Product/Service Details: What you sell and its unique value proposition.

- Financial Estimates: Startup costs, pricing strategy, and initial revenue projections.

Doing this groundwork now is the smart way to build a plan that gets results. ✓

With your preliminary research complete, you’re ready to start building. The following sections will walk you through each component of a professional small business plan outline, ensuring you cover every detail that matters. Let’s get started.

Section 1: The Executive Summary – Your First Impression

Think of the executive summary as the movie trailer for your business. It’s the very first thing a lender or investor will read, but it should be the absolute last thing you write. Why? Because it’s a high-level summary of everything else in your document. Its goal is simple and critical: grab their attention and convince them the rest of your plan is worth their valuable time. According to the U.S. Small Business Administration, this is a vital step when you write your business plan, as it sets the stage for success.

Keep it concise, powerful, and ideally to a single page-two at the maximum. This isn’t the place for jargon or long-winded backstories; it’s a high-impact overview that makes a strong case for your business, fast. Getting this section right establishes a professional tone for your entire small business plan outline and shows you respect the reader’s time.

What to Include in Your Executive Summary

To be effective, your summary needs to hit several key points instantly. No fluff, just the essentials that answer the most pressing questions a reader will have. Pack a punch by including these core components:

- Your Mission Statement: In one or two clear sentences, what is your company’s purpose? This is your “why” and it should be compelling.

- Company Information: State your business name, legal structure (e.g., LLC, S-Corp), location, and introduce the key people on your leadership team.

- Products or Services: Briefly describe what you sell and, more importantly, what problem you solve for your target market. Focus on the unique value you provide that competitors don’t.

- Financial Highlights & Funding Request: Showcase key financial data, like projected revenue for the next three years or current profit margins. If you’re seeking funding, state exactly how much you need and precisely how it will be used to fuel growth.

Common Mistakes to Avoid

A great executive summary can open doors, while a poor one can slam them shut before you even get a chance. It’s your first impression, so make it count. Steer clear of these common pitfalls that can undermine your credibility:

- Making it too long. A rambling summary suggests a lack of focus. If you can’t summarize your business in a page, it raises doubts about your ability to execute the plan.

- Being vague. Avoid buzzwords and empty phrases like “world-class” or “disruptive.” Instead, use concrete goals and data: “Acquire 1,000 new customers in Year 1 by investing 15% of revenue in targeted digital ads.”

- Forgetting your audience. Tailor your summary. A banker wants to see a clear path to loan repayment and low risk. A venture capitalist is looking for massive growth potential and a strong exit strategy. Highlight what matters most to them.

Sections 2 & 3: Company Description & Market Analysis

Think of these two sections as the one-two punch that validates your entire business concept. Your Company Description explains who you are, and the Market Analysis proves there’s a paying audience for what you do. By combining them, you create a powerful narrative that establishes your expertise and the viability of your venture. This is a critical step in any professional small business plan outline, setting the stage for your financial projections and marketing strategy.

Crafting Your Company Description

This is your chance to clearly and concisely define your business. Don’t waste words. Get straight to the point and answer the fundamental questions every stakeholder will have. Focus on three core elements:

- The Problem You Solve: Clearly articulate the pain point your customers face and how your product or service is the ideal solution. What makes you essential?

- Your Legal Structure: State whether you are a sole proprietorship, LLC, S-Corp, etc. This defines your liability and tax obligations.

- Your Competitive Advantages: What is your “secret sauce”? This could be proprietary technology, a unique service model, a key partnership, or a cost advantage that competitors can’t easily replicate.

Conducting Your Market Analysis

An idea is worthless without a market. This section is where you prove, with data, that a real opportunity exists. A thorough analysis, often structured as a SWOT and recommended in frameworks like the SCORE Business Plan Outline, shows investors you understand the landscape. Your goal is to demonstrate deep industry knowledge.

- Define Your Target Market: Who are your ideal customers? Go beyond basic demographics to include their behaviors, needs, and buying habits. Create a clear customer persona.

- Industry Outlook: Provide a snapshot of your industry. Include its current size, historical growth, key trends, and future growth potential.

- Competitive Analysis: Identify your top 3-5 competitors. Analyze their strengths and weaknesses (a SWOT analysis is perfect for this) to pinpoint opportunities for your business to excel.

Proving Your Concept

Finally, back up all your claims with hard evidence. Assumptions won’t secure funding or guide your strategy. Show the results of any surveys, focus groups, pre-orders, or beta testing you’ve completed. Use credible, verifiable statistics to support your market size and growth claims. This research is often the most time-consuming part of creating a small business plan outline, but it’s non-negotiable for proving your concept is sound. Why spend weeks stressing over it? Let AI perform your market analysis in minutes.

Sections 4 & 5: Organization & Management and Products/Services

You’ve defined the market and your strategy. Now, it’s time to detail the engine of your business: your team and your product. These two sections are critical for convincing investors you have more than just an idea-you have a viable operation. They want to see a clear structure, an expert team, and a compelling offer. This part of your small business plan outline turns your vision into a concrete reality.

A great idea is nothing without a team to execute it and a product that customers actually want. Getting these sections right proves you have both.

Structuring Your Organization and Management Team

Who is running the show? This section proves you have the expertise to succeed. Don’t just list names; showcase the specific experience that makes your team the perfect fit for this venture. A simple organizational chart can instantly clarify roles, and you should also clearly define your legal structure (e.g., LLC, S-Corp) and ownership percentages. Clarity here builds immediate confidence.

- Management Bios: Keep them short and results-focused. Example: “Jane Doe, CEO: 10+ years in SaaS product management, grew previous company’s user base by 300%.”

- Organizational Chart: A simple visual showing who reports to whom.

- Legal Structure: State whether you’re an LLC, corporation, or sole proprietorship.

Detailing Your Products or Services

This is where you make your offer irresistible. Don’t just list features-sell the solution. Clearly describe your product or service and, most importantly, the unique value it provides to your customer. How does it save them time, make them money, or improve their life? Briefly cover your product’s lifecycle from development to market and mention any intellectual property like patents or trademarks. This is your competitive advantage.

Nailing these sections shows you’ve thought through both the “who” and the “what” of your company. It demonstrates that your management is qualified and your product is well-defined and defensible. A complete small business plan outline requires this level of detail to be taken seriously by lenders, partners, and investors. Get this right, and you’re miles ahead of the competition.

Sections 6 & 7: Marketing/Sales Strategy & Funding Request

You’ve defined your business and analyzed the market. Now it’s time for action. These sections detail exactly how you will attract customers and what capital you need to succeed. This part of your small business plan outline transforms your strategy into a clear, measurable roadmap for generating revenue.

Building Your Marketing and Sales Plan

Your marketing and sales strategy is your playbook for customer acquisition. It proves you have a realistic plan to connect your product with paying customers. Don’t just list ideas; explain the logic behind them. Answer these four key questions:

- Positioning: How will customers see your brand? Are you the affordable option, the luxury choice, or the most innovative solution? Your brand identity must be clear and consistent.

- Pricing: What is your pricing model and why does it make sense? Justify your price based on value, market rates, and production costs. For example, a premium price must be backed by premium quality.

- Promotion: Where will you reach your target audience? List the specific channels you’ll use, such as Google Ads, Instagram marketing, local SEO, email campaigns, or industry trade shows.

- Sales Process: How does a potential lead become a paying customer? Outline the steps, from initial contact (e.g., website visit) to closing the sale (e.g., online checkout or signed contract).

Defining Your Funding Request

If you’re seeking investment, this section must be precise and persuasive. Vague requests are a major red flag for lenders and investors. A detailed funding request is a non-negotiable part of any small business plan outline used to secure capital. Be direct and transparent.

Clearly state:

- The exact amount you need. Specify your total funding requirement for the next five years (e.g., “$75,000”).

- How the funds will be used. Provide a detailed breakdown. For example: New equipment ($25,000), initial marketing campaigns ($20,000), salaries for two staff ($25,000), and operational overhead ($5,000).

- Your future financial plans. Briefly describe your long-term intentions. This could include your loan repayment schedule, plans for a future sale of the business (exit strategy), or when you might seek another round of funding.

Struggling to connect these numbers? The right tool can build these sections instantly, ensuring they are professional and lender-ready. Why stress for weeks? Get started with GrowthGrid now →

Section 8: Financial Projections – The Most Crucial Section

Welcome to the section that separates a dream from a viable business. Your financial projections translate your vision, market research, and operational strategy into concrete numbers. This is where you prove your business has the potential to be profitable and sustainable.

Let’s be direct: this is the most challenging part for most entrepreneurs. But your numbers can’t be pulled from thin air. Every projection must be based on logical assumptions derived from your market analysis. For a detailed view, we recommend creating monthly or quarterly projections for your first year of operation, followed by annual projections for years two through five. This part of your small business plan outline is what investors will scrutinize the most.

Key Financial Statements to Include

Don’t get lost in complex accounting. A powerful financial forecast focuses on three core statements that tell the story of your business’s health:

- Income Statement: Also known as a Profit & Loss (P&L), this statement projects your revenues, costs, and ultimate profitability over a specific period.

- Cash Flow Statement: This is critical. It tracks the actual cash moving in and out of your business, showing if you can cover expenses like payroll and rent. Profit doesn’t equal cash in the bank.

- Balance Sheet: This provides a snapshot of your company’s financial position at a single point in time, summarizing your assets, liabilities, and owner’s equity.

Making Sense of the Numbers

Numbers alone aren’t enough. You must include a brief narrative explaining your key assumptions. Why do you expect a 10% growth in Q3? What’s your projected customer acquisition cost? Also, include a break-even analysis-this shows exactly when your business will become profitable.

This is where most founders get stuck. 😰 Juggling spreadsheets, validating formulas, and making realistic assumptions is incredibly time-consuming and stressful. Getting it wrong can undermine your entire plan.

Why struggle for weeks? You can have professional, bank-ready financials in minutes.

Stop stressing over spreadsheets. Generate perfect financials with AI.

From Outline to Action: The Smart Way Forward

You now have the complete blueprint for success. A business plan is your strategic roadmap, and getting the details right-especially the financial projections-is what separates a good idea from a fundable business. This comprehensive small business plan outline provides the structure, but filling it out can take weeks of painstaking work.

But what if you could skip the grind? Why stress for weeks when you can have a professional plan in minutes? Join over 50,000 startups who use GrowthGrid to instantly create a 40+ page, investor-ready plan. It’s fast, efficient, and backed by our 100% Satisfaction Guarantee.

Your vision is too important to wait. Ready to skip the hard work? Generate your complete business plan in 8 minutes. Your future starts now. ✨

Frequently Asked Questions

How long should a small business plan be?

There’s no magic number. A traditional plan for a lender, following a detailed small business plan outline, is often 25-40 pages. It needs to be thorough. For internal use, a “lean plan” focusing on key strategies can be just a few pages. The goal is efficiency and clarity. Focus on providing the necessary information for your audience without unnecessary filler. A concise, powerful plan is always better than a long, weak one.

What is the most important section of a business plan?

While every section is vital, investors and lenders focus heavily on two: the Executive Summary and the Financial Projections. The Executive Summary is your first impression-it must be compelling and concise. The Financial Projections are the proof that your business is a viable investment. These sections show that you have a clear vision and that the numbers behind it are solid. Nail these, and you’re on the right track.

Can I write a business plan myself without a consultant?

Absolutely. In fact, it’s the smart way to do it. Consultants are expensive and time-consuming. You are the expert on your own business vision. Using a professional template or a modern business plan tool gives you the structure you need to create a high-quality, comprehensive plan yourself. This saves you thousands of dollars and ensures the final document truly reflects your goals and passion. You can do this efficiently and affordably.

How often should I update my business plan?

Your business plan is a living document, not a static one. Think of it as your strategic GPS. You should conduct a major review annually or whenever your business faces a significant change-like launching a major product, entering a new market, or seeking another round of funding. A quick quarterly check-in on your financial targets and milestones is also a smart, results-oriented habit for staying on course.

What’s the difference between a business plan and a business proposal?

It’s simple: one is internal, the other is external. A business plan is your company’s complete strategic roadmap, detailing your A-to-Z vision, operations, and financials. A business proposal is a focused sales document sent to a specific potential client to win a project. The plan is about the entire health and future of your business; the proposal is about making a single sale.

Is a lean business plan good enough to get a loan?

Typically, no. A lean plan is a fantastic tool for internal strategy and fast-paced planning. However, banks and formal investors require a much deeper level of detail to assess risk. For a loan application, you will need a traditional, comprehensive document built from a complete small business plan outline. This includes detailed financial statements, in-depth market analysis, and a full operational plan to prove your venture is a secure investment.