Think of a startup business plan template as less of a stuffy document for investors and more of a personal roadmap for your small business. It's the tool that helps you, the entrepreneur, untangle the mess of ideas in your head and lay them out in a clear, strategic path forward. For a small business owner, a template turns an overwhelming task into a manageable, step-by-step process.

It forces you to get honest about the nitty-gritty details of your business model—operations, finances, and how you’ll actually find and keep customers.

Your Business Plan Is Your Strategic North Star

I get it. A lot of small entrepreneurs wonder if they really need a formal business plan. It’s easy to dismiss it as a corporate relic that just collects dust on a shelf, especially when you're busy just trying to get your business off the ground. But that view totally misses the point.

The real magic isn't in the finished document itself; it’s in the journey of creating it. The process forces you to drag all those brilliant, half-formed ideas out of your brain and pin them down on paper, giving you a crystal-clear picture of your entire business model.

From Fuzzy Idea to Clear Strategy

When you start filling in the blanks on a template, you're forced to get specific. Who, exactly, is your customer? What problem are you genuinely solving for them? How is your small business actually different from the ten other companies that seem to do the same thing? Answering these questions is the bedrock of a killer marketing plan and a brand that people actually connect with.

The data doesn't lie. Research shows that businesses with a formal plan are 152% more likely to actually get off the ground. Not only that, but they tend to grow 30% faster than those winging it. And if you're seeking a small business loan, know that a jaw-dropping 69% of venture capitalists (and bankers alike) won't even consider investing without seeing a business plan first, according to stats compiled by upmetrics.co.

Your business plan is an internal guide before it's ever an external pitch. It gets you and any partners on the same page, clarifies your priorities, and gives you a yardstick to measure your progress against.

Ultimately, this document becomes your decision-making compass. It helps you see potential roadblocks before you hit them, figure out where to spend your limited cash, and make smart pivots when the market throws you a curveball. A solid plan built from a good template doesn't just boost your chances of getting funded—it seriously improves your odds of building a business that lasts.

Choosing the Right Business Plan Format

Let's get one thing straight: not all business plan templates are built the same. Picking the right format is your first real strategic move, and it all boils down to what you, as a small entrepreneur, need to accomplish right now. Are you about to walk into a bank to ask for a loan, or are you still sketching out your idea on a napkin, trying to see if it even has legs?

Your answer will point you toward either a classic, in-depth business plan or a more modern, agile format like the Lean Canvas.

Traditional Plans Versus Lean Models

When you think "business plan," you're probably picturing the traditional business plan. It's the big one—a comprehensive, detailed document that usually runs somewhere between 15 to 30 pages. This is a deep dive into your entire operation, covering everything from your company's mission statement all the way down to five-year financial projections.

This format is absolutely essential if your main goal is to secure a bank loan or get serious investors on board. They need to see that you've done your homework and meticulously thought through every single aspect of your market and operational strategy. It shows you're serious and have a solid business model.

Then there's the Lean Canvas model. This is a completely different beast. It's a one-page, action-oriented snapshot of your business model. It’s built for speed and agility, forcing you to focus on the absolute core assumptions: your unique value proposition, key customer segments, and the metrics that actually matter.

This is the go-to tool for modern entrepreneurs, especially if you're bootstrapping or know you'll need to pivot quickly based on real feedback from the market. The priority here isn't exhaustive documentation; it's about validating your idea and finding a path to a sustainable business, fast.

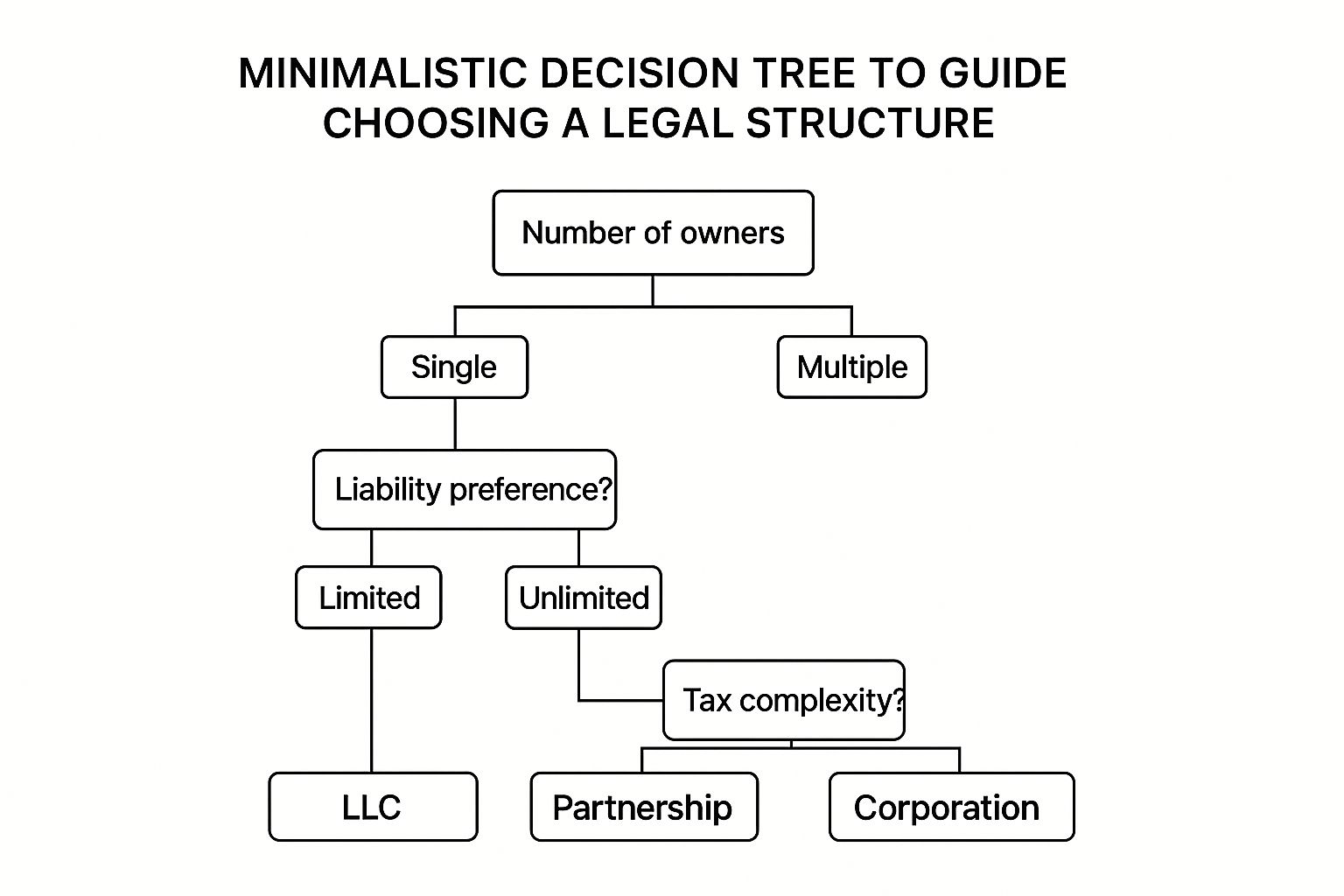

The choice between these formats often mirrors other foundational decisions, like your legal structure. This decision tree can help you see how factors like ownership and liability play into that.

As you can see, a solo entrepreneur who values simplicity might lean toward a Sole Proprietorship. But if you have a partner and want to protect your personal assets, an LLC or Corporation starts to make a lot more sense.

To help you decide which plan is right for you, here’s a quick breakdown of the two main formats.

Classic Business Plan vs Lean Canvas Template

| Feature | Classic Business Plan | Lean Canvas Template |

|---|---|---|

| Length | 15-30+ pages | 1 page |

| Best For | Securing loans, attracting traditional investors | Validating ideas, early-stage startups, pivoting |

| Focus | Detailed planning, execution, and financial forecasting | Problems, solutions, key metrics, and customer segments |

| Creation Time | Weeks to months | Hours to days |

| Flexibility | Low; difficult to change once written | High; designed for rapid iteration and updates |

| Audience | External (banks, investors) | Internal (founders, team), early-stage advisors |

Ultimately, the format you choose sends a signal.

A detailed plan demonstrates diligence to investors, while a lean plan proves your ability to adapt. Choose the tool that best serves your current mission.

For a lot of small business owners, seeing a completed plan makes the choice much clearer. Take a look at this detailed startup business plan example for a coffee shop to get a feel for how a traditional model is structured for a classic brick-and-mortar business. It really highlights the level of detail that old-school investors and lenders expect to see.

Crafting a Compelling Executive Summary

Let's be honest, your executive summary is probably the only part of your business plan that gets a guaranteed read-through. Think of it as the trailer for your entire business venture. Its one job? To grab the reader by the collar and make them need to know more.

This isn't the place for a slow build-up. You need to come out swinging. Your opening line should be a crystal-clear statement of what your business does, the specific problem you’re fixing, and who you're fixing it for.

Imagine you're launching a local, eco-friendly cleaning service. A great opening could be: "We provide non-toxic, subscription-based cleaning services for busy urban families who want a healthier home without the hassle." Boom. In one sentence, we know the service, the customer, and the core value.

What to Pack Into Your Summary

Once you have their attention, you need to deliver the goods—fast. A solid executive summary for any small business has to touch on a few critical points. No fluff, just the essentials.

- The Problem: What's the specific pain point you're solving?

- Your Solution: How does your product or service make that pain go away?

- Target Market: Who are your customers and how big is this opportunity?

- The Team: Who’s on the bus? Why are you the right person to make this happen?

- Financial Highlights: What are you asking for? Give them a sneak peek at key numbers, like projected revenue or when you expect to break even.

Pro Tip: Always, and I mean always, write your executive summary last. It's infinitely easier to summarize your detailed marketing strategies and financial forecasts after you've already wrestled with them. Trying to do it first is a recipe for frustration and a weak summary.

Nailing these elements creates a powerful, concise story. It shows potential lenders or partners you've thought through not just the big idea, but also the nitty-gritty details of the business model required to turn that vision into a real, thriving business.

Building Your Market Analysis and Marketing Plan

A brilliant idea is just that—an idea. To turn it into a real business, you have to prove there are actual, paying customers out there who need what you're selling. This is where your market analysis comes in; it's the bedrock of your entire marketing plan and sales strategy.

First things first, get crystal clear on who you're selling to. "Everyone" is not a target market. As a small business owner, you need to paint a vivid picture of your ideal customer. What keeps them up at night? What are their daily frustrations? Where do they hang out online? Answering these questions is how you find the pain points your business model is built to solve.

Defining Your Customer and Competitive Edge

Once you know your customer intimately, it's time to size up the competition. This isn't just a simple list of who else is out there. You need to dig in and figure out what they do well and, more importantly, where they're dropping the ball.

Those gaps are your opportunities. Your unique selling proposition (USP)—that thing that makes you the obvious choice for your customer—should jump right out from this analysis.

This research is absolutely essential for validating your business model before you burn through your cash. If you want to go deeper on this, our guide on conducting a feasibility study gives you a step-by-step framework.

A great marketing plan isn’t about having the biggest budget. It’s about having the smartest strategy, built on a genuine understanding of your market. This is how small businesses outmaneuver larger competitors.

All this groundwork flows directly into your marketing plan. This is the "how"—the specific tactics you'll use to get noticed, make sales, and keep people coming back. Your plan needs to be realistic and built for a small business budget.

Think through a few key areas:

- Acquisition Channels: How will people find out you exist? Will you focus on hyper-targeted Facebook ads, dominate local search results, build a following with great content, or team up with other local businesses?

- Brand Messaging: What's the one core idea you want to stick in your customer's mind? It needs to be simple, powerful, and instantly communicate your value.

- Sales Process: What does the journey look like from a curious visitor to a happy, paying customer? Map it out.

The small business world is exploding. Projections show a 21% annual increase by 2025, mostly fueled by a new wave of entrepreneurs. That incredible growth means more noise and more competition, which makes a sharp, well-researched marketing plan more critical than ever for any small business. For more context on these trends, you can check out some detailed entrepreneurship statistics and insights on hostinger.com.

Making Sense of Your Financial Projections

Alright, let's talk about the part of the business plan that makes most small entrepreneurs break out in a cold sweat: the financials.

For many of us, this is where the fun, creative ideas slam into the harsh reality of spreadsheets and numbers. It’s intimidating, and it’s easy to feel like you’re in over your head without an MBA. But here’s the thing: this section is what gives your startup business plan template its teeth.

You don't need to be a CPA. What you do need to do is tell a believable story with your numbers. Anyone reading your plan—from a banker to a potential partner—is looking for one thing: proof that you understand how your business model will actually work financially. They want to see that you’ve thought through how you’ll make money, how you’ll spend it, and when you’ll turn a profit.

The Core Financial Statements

Think of your financial projections as three different snapshots of your company's financial health. Each one tells a slightly different part of the story, and together they create a complete picture.

Here are the three must-haves every small business owner needs to tackle:

- Sales Forecast: This is your best guess at what you’ll sell. How do you make it an educated guess? By looking at your market research, your pricing, and how your marketing plan will get the word out. It’s not a wish, it’s a data-backed prediction.

- Expense Budget: What’s it going to cost to keep the lights on? You’ll have fixed costs that don't change much (think rent) and variable costs that do (like materials or ad spend). Get granular here.

- Cash Flow Statement: This one is absolutely critical for a small business. It tracks the actual cash moving in and out of your bank account. A business can be profitable on paper but still fail because it runs out of cash. Don't let that be you.

The point isn't to be a fortune-teller. Nobody expects you to predict the future perfectly. The real goal is to prove you've done your homework and have a sensible plan for managing your money.

One other incredibly useful tool to include is your break-even analysis. This calculation tells you the exact sales volume you need to hit to cover all your costs. It’s the magic number where you officially stop losing money and start making it. Knowing this number gives you a real, tangible target to shoot for and turns a lofty financial goal into a concrete milestone for your business.

Common Questions About Business Plans

Even with the best startup business plan template in hand, you’re bound to hit a few roadblocks. It’s just part of the process for any entrepreneur. Turning a great idea into a solid strategy always brings up questions, so let’s walk through a few of the most common ones I hear from small business owners.

How Long Should My Business Plan Be?

There's no one-size-fits-all answer here. For a traditional plan you're putting in front of a bank, you're probably looking at a solid 15-25 pages. On the other hand, something like a Lean Canvas is designed to be just a single page.

The real key is to be comprehensive but concise. Bankers and investors are busy people; they want you to get to the point. Always choose clarity over word count.

A great business plan is as long as it needs to be and not a word longer. Focus on providing just enough detail to tell a compelling story and prove you've done your homework.

Should I Write the Business Plan Myself?

Yes, you absolutely should. As the entrepreneur, nobody understands the vision, the business model, and the market better than you. Honestly, the act of writing the plan is an incredibly valuable exercise in itself—it forces you to clarify your own thoughts and spot weaknesses you might have missed.

You can always bring in an accountant or a consultant to help polish the final draft, but the core strategy has to come from you. It’s your vision, after all.

How Often Should I Update My Plan?

Think of your business plan as a living, breathing document, not something you write once and file away. You should be reviewing and updating it at least once a year.

But more importantly, you need to revisit it any time something significant changes. This could be anything from:

- Launching a new product line.

- Expanding into a new city or country.

- A major competitor making a big move.

- Securing a small business loan.

For very new businesses, it’s not uncommon to be tweaking your plan every month as you get more customer feedback and real data. And as your small business starts to grow, don't forget about other foundational documents. If you bring on a partner, it's a smart move to read up on things like putting together a solid shareholder agreement to make sure everyone is protected.

Ready to build a professional, investor-ready business plan in minutes? Let GrowthGrid do the heavy lifting. Our AI-powered platform turns your ideas into a polished, comprehensive plan, so you can focus on building your business. Get started for free today!