A break-even analysis template is an essential tool for any small business owner or entrepreneur. It's your roadmap for figuring out the exact point where your total sales cover your total costs. This isn't just a nice-to-have; it's a critical component of a solid business plan. It tells you precisely how many units you need to sell or how much revenue you need to generate before your business model becomes profitable.

It’s that financial milestone where you're officially out of the red. You aren't losing money anymore, but you haven't started gaining any either. For a small entrepreneur, knowing this number is the first step toward building a sustainable venture.

Find Your Path to Profitability

Every great business starts with an idea. But an idea only becomes a viable business model when you can prove it makes financial sense. This is where a break-even analysis acts as your strategic map, turning ambitious goals into hard numbers. It’s a foundational piece of any solid business plan, giving you a clear-eyed view of your path to actually making money and validating your venture.

For a small entrepreneur, think of it less like a stuffy accounting task and more like a reality check for your business plan. It forces you to get up close and personal with the numbers that will make or break your new business.

The Essential Components of Break Even

At its core, this whole analysis boils down to three key figures. Once you get a handle on these, you're well on your way to building a business model that can last.

- Fixed Costs: These are the predictable bills you have to pay every month, no matter what. They don't change whether you sell one item or a thousand. We're talking about things like rent for your co-working space, your monthly QuickBooks subscription, or your own salary as the founder.

- Variable Costs: These expenses are directly linked to your sales. If you're a small business launching a coffee shop, this is the cost of the beans, milk, and cup for every single latte you sell. For a solo digital marketer, it might be the ad spend for a particular client's campaign. More sales mean higher variable costs.

- Contribution Margin: This is the magic number for your business model. It's the profit you make from selling just one item, before you even think about your fixed costs. You find it by taking your selling price and subtracting the variable cost for that one unit.

A high contribution margin is a great sign for any small business. It means more cash from each sale goes directly toward covering your fixed costs, helping you reach profitability that much faster.

Putting It All Together for Your Business Plan

Let's use a real-world example for a small entrepreneur. Say you're drafting a business plan for a new coffee shop.

Your fixed costs—rent, utilities, and a barista's wages—add up to $4,000 a month. That's your baseline. You plan to sell each cup of coffee for $5, and the variable costs for that cup (beans, lid, sleeve) come out to $2.

This means your contribution margin is $3 for every coffee sold ($5 price – $2 cost).

With these simple numbers, your business plan can now state exactly how many coffees you need to sell just to keep the lights on. This isn't an abstract figure; it's a concrete sales goal. It shapes your marketing plan, your staffing, and your operational targets. It tells you if your pricing is right and, most importantly, when all your hard work as an entrepreneur will finally start to pay off.

Gathering Your Financial Puzzle Pieces

Any break-even analysis is only as good as the numbers you feed it. Before you even touch a template, every small business owner has to roll up their sleeves and assemble the financial pieces of their business puzzle. This isn't just busywork; it's about digging into your expenses and sorting them into the right buckets to lay a solid foundation for an accurate result in your business plan.

Think of this process as a mini financial audit for your business model. It forces you to look at every single dollar your business spends, helping you understand precisely where your money is going. The goal here is to leave no stone unturned and no cost unaccounted for.

Distinguishing Fixed From Variable Costs

The first, and most crucial, task for any entrepreneur is separating costs into two primary categories: fixed and variable. Honestly, getting this right is non-negotiable if you want a calculation you can trust for your business plan.

Fixed costs are your predictable, recurring expenses. These are the bills you have to pay every month, no matter how much you sell. They're the financial bedrock of your operation—things like the rent for your storefront, that monthly QuickBooks subscription, or your insurance premium. These costs stay the same whether your small business sells one widget or a thousand.

Variable costs, on the other hand, are the ones that fluctuate directly with your sales volume. These expenses are tied to the creation of each unit or the delivery of each service. For a small e-commerce store, this would be the cost of the product itself, the branded packaging you use, and the shipping fees for every single order.

I see new entrepreneurs make this mistake all the time: they misclassify costs. For instance, a salaried employee is a fixed cost, but a freelance designer you pay per project is a variable cost. That small distinction can dramatically shift your break-even point and the viability of your business model.

Let's look at a real-world example. A small bakery wants to create a realistic business plan. It has fixed costs of $4,000 per month (rent, salaries, utilities). Each loaf of bread sells for $5, with $2 in variable costs (flour, yeast, packaging). That means the bakery earns a gross profit of $3 per loaf. To break even, it needs to sell 1,334 loaves every single month. This number becomes a core KPI for their marketing plan.

Knowing how to properly categorize your costs is a game-changer. Here’s a quick table to help any small entrepreneur nail it down.

Fixed vs Variable Costs for a Small Business

| Expense Category | Fixed Cost Example | Variable Cost Example | Why It Matters for Your Business Plan |

|---|---|---|---|

| Rent & Utilities | Monthly lease payment for your retail space | Electricity bill that increases with production | Some utilities are fixed (internet), while others can be variable (factory power). |

| Labor | Annual salary for a full-time manager | Commission paid to a salesperson per sale | How you structure compensation directly impacts your cost structure and business model. |

| Software & Tools | Monthly subscription for CRM software (e.g., HubSpot) | Transaction fees from Stripe or PayPal | Subscription fees are predictable, while transaction fees scale with revenue. |

| Marketing & Advertising | Retainer fee for a marketing agency | Pay-per-click (PPC) ad spend for your marketing plan | A fixed retainer is a set cost, while PPC spend is directly tied to customer acquisition volume. |

This distinction is fundamental because it affects your pricing, profitability, and overall business strategy.

Locating Your Financial Data

So, where does a small business owner find all this information? If you're running an existing business, your accounting software, bank statements, and old profit-and-loss reports are gold mines of data.

If you’re just starting out and building your initial business plan, you'll need to do some homework and make educated estimates. This initial research is a lot like conducting a feasibility study to make sure your business idea is actually viable.

To make things easier, here's a checklist for small entrepreneurs to get started on identifying common costs:

-

Fixed Costs You Might Have:

- Rent or mortgage payments for your workspace

- Salaries for your full-time staff

- Business insurance premiums

- Monthly software subscriptions (CRM, email marketing, etc.)

- Basic utilities like internet and phone lines

- Repayments on any business loans

-

Common Variable Costs to Look For:

- Raw materials or cost of goods sold (inventory)

- Production-specific supplies

- Packaging and shipping materials

- Sales commissions for your team

- Payment processing fees (those pesky 2.9% + 30¢ fees)

- Performance-based advertising spend (like PPC ads in your marketing plan)

By methodically gathering and sorting these expenses, you'll have everything you need to confidently fill out your break-even analysis template. This organized list is the key to creating an actionable picture of your business's path to profitability.

Using Your Break-Even Analysis Template

Alright, you've done the hard work of gathering your cost data. Now for the exciting part: putting it all together to see what it really means for your business. This is where a good break-even analysis template, whether in Excel or Google Sheets, becomes a small business owner's best friend. It takes you out of the abstract and gives you a concrete, dynamic tool to steer your business plan.

You don't need to be a spreadsheet guru for this. The best templates have all the formulas baked right in. Your job is simply to plug in your numbers—your fixed costs, variable costs per unit, and your selling price. The spreadsheet does the heavy lifting for your business model.

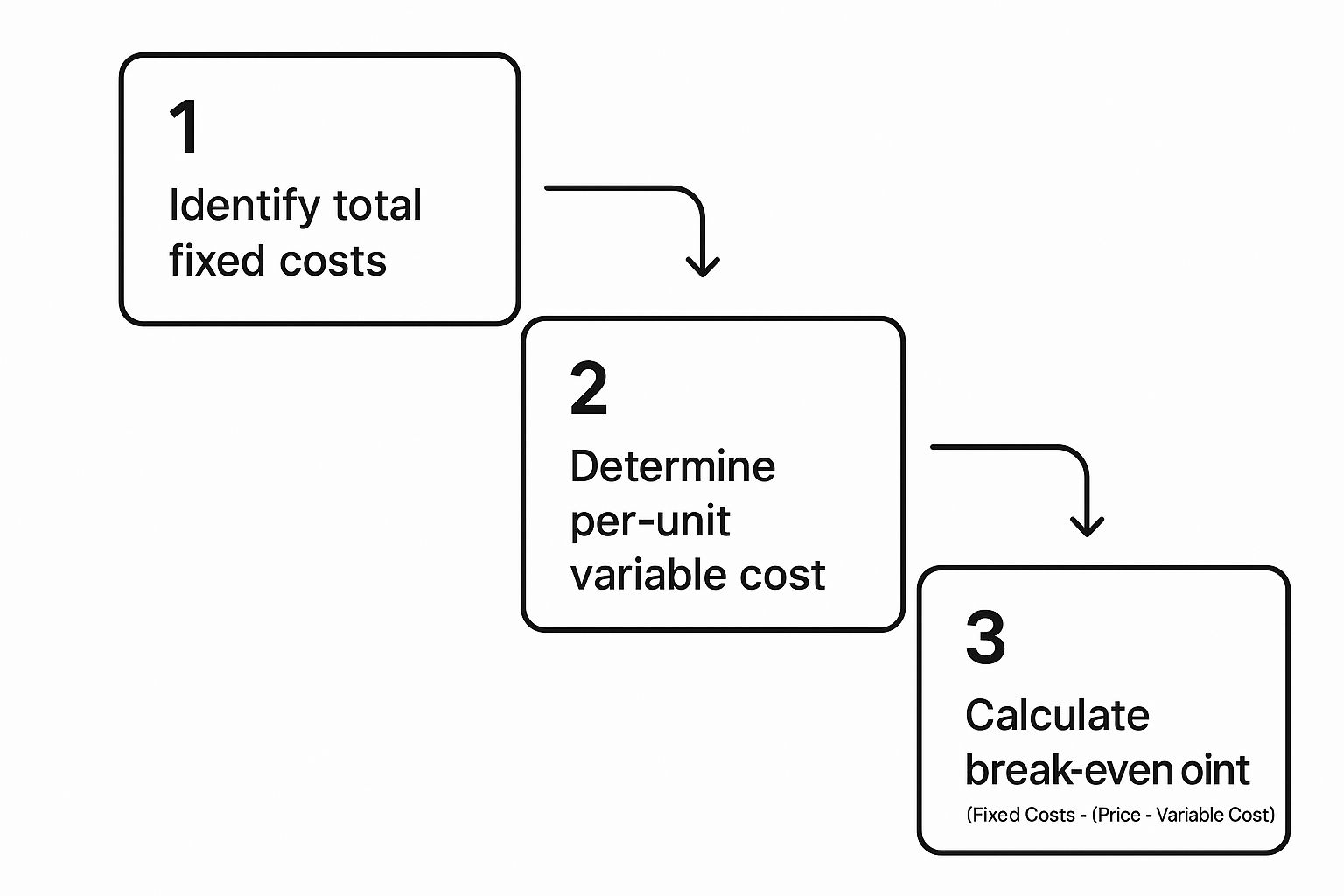

Plugging Your Numbers Into the Template

The process is refreshingly simple. You're just taking those financial puzzle pieces you just collected and dropping them into the right spots. For a small entrepreneur, this kind of clarity is priceless.

- Total Fixed Costs: Add up all those expenses that don't change month to month—think rent, salaries, software subscriptions—and pop that total in.

- Per-Unit Variable Cost: This is the cost tied to making or selling one item. Tally up the materials, packaging, and any direct labor or shipping costs and enter that figure.

- Selling Price Per Unit: What does a customer pay for one of your products or services? That’s the number you put here.

As soon as you enter these three key figures, the template will instantly calculate your break-even point. It gives you the answer in two incredibly useful ways for your business plan: the number of units you need to sell and the total sales revenue you need to generate just to cover your costs.

This is the core calculation the template is doing behind the scenes.

This simple visual breaks down how your fixed and variable costs directly feed into that final break-even result, a crucial metric for any business plan.

From Calculation to Actionable Insight

Seeing your break-even number for the first time is a real lightbulb moment for most entrepreneurs. It transforms "making a profit" from a vague wish into a tangible, measurable sales target for your marketing plan.

For instance, if your template reveals you need to sell 150 units a month to break even, that's no longer just a number. It's a daily goal of selling five units. Simple as that.

Suddenly, you can ask a critical question: is my marketing plan actually set up to bring in five paying customers every single day? This forces you to connect your marketing strategy directly to the financial realities of your business model, ensuring your efforts are aligned with what it takes to succeed.

The real power of a break-even analysis template is that it's a living document, not a one-and-done calculation. For a small entrepreneur, it's a financial flight simulator for your business.

Wondering what would happen if you raised your price by 10%? Just tweak the "Selling Price" cell and watch your break-even point change instantly. Thinking about switching to a more affordable supplier? Lower your "Variable Cost" and see exactly how many fewer units you'd have to sell each month.

Playing with these "what-if" scenarios is essential for smart, strategic decision-making. You can see how this plays out by exploring a sample business plan for a coffee shop, which shows how pricing and cost changes impact the bottom line. This lets you test drive potential business moves on paper before you risk a single dollar of real capital, turning your template into a powerful strategic weapon for your small business.

Making Smarter Business Decisions

A break-even analysis is so much more than a math problem; it's a strategic compass for your entire business plan. Once you’ve nailed down that magic number—the point where your business model is no longer losing money—you can stop thinking about just surviving and start making confident decisions that shape your future. It's about testing ideas on paper before you risk a single dollar of real capital.

This is where the conversation shifts from a nervous "Can we afford this?" to a strategic "What does our marketing plan need to achieve to make this profitable?" For any small entrepreneur, that change in perspective is a game-changer. It replaces guesswork with a clear, actionable plan.

Modeling "What-If" Scenarios

The true power of your break-even template really shines when you start playing with the numbers. Think of it as your financial sandbox—a place to model different futures for your business model without any real-world consequences. It's how you get clear answers to the tough questions every small business owner faces.

Let's look at a few common situations for entrepreneurs:

- Pricing a New Service: A freelance consultant is developing her business plan and wants to roll out a new marketing package. By plugging in different price points, she can instantly see how many clients her marketing plan needs to land to turn a profit at each level.

- Evaluating Marketing ROI: A small e-commerce store is about to drop $1,000 on a Facebook ad campaign. The analysis will tell them exactly how many extra units they need to sell just to cover the ad spend. Suddenly, the true ROI of the marketing plan becomes crystal clear.

- Deciding When to Hire: A service business is bursting at the seams and thinking about bringing on its first full-time employee. By adding that new salary to the fixed costs, the owner can see the immediate jump in their break-even point and decide if sales can truly support the expansion.

This forward-looking approach is the secret to sustainable growth for any small business. It helps you see around corners, spot opportunities, and build a business model that can pivot when the market inevitably changes.

A Practical Example for a Service Business

Imagine you're a small entrepreneur, a graphic designer, launching a new "branding package" for $2,500. Let’s say your variable costs for each package—things like special software licenses or freelance help—come out to $500. Your monthly fixed costs for running your business (rent, utilities, etc.) are $4,000.

A quick break-even calculation shows you need to sell just two packages every month to cover your bills. That single piece of information is gold. It turns a fuzzy goal into a concrete target your marketing plan can aim for.

This kind of thinking is essential for validating any business model, whether you're a solopreneur or running a small manufacturing plant. A small business with $100,000 in annual fixed costs and a $50 gross profit per unit knows they must sell 2,000 units to break even. That number directly drives their production schedules and marketing plans.

By making this analysis a regular part of your business planning, you build a solid bridge between your financial reality and your strategic ambitions. For more tools to build a solid business framework, check out our Starter Pack for entrepreneurs. It’s this kind of proactive planning that gives small business owners a real competitive edge.

Common Mistakes and How to Avoid Them

A break-even analysis can be an incredible tool for making smart business decisions, but only if the numbers you plug in are right. For a small entrepreneur, a flawed calculation can lead to a flawed business plan. Even experienced business owners can get tripped up by a few common mistakes, so let's walk through them. Getting this right from the start is the key to building a strategy you can actually count on.

One of the biggest traps for a new business owner is simply getting costs mixed up. It sounds basic, but confusing a fixed cost with a variable one happens all the time, and it can throw your entire business model out of whack.

Let's say a small catering business owner treats her part-time kitchen staff's wages as a fixed cost in her business plan. But she only calls them in when she has a catering gig. In reality, their pay is directly tied to her sales—that makes it a variable cost. Because of that simple mix-up, she thinks her profit margin on each event is much healthier than it is. This leads her to underprice her services, and she's left wondering why her business is struggling to pay the bills at the end of the month.

Overlooking the Hidden Expenses

Another classic blunder for entrepreneurs is forgetting all the little costs that quietly eat away at your bottom line. When you're focused on the big stuff like rent or inventory for your business plan, it's easy to let the small "hidden" expenses slip through the cracks. They might not seem like much on their own, but they add up.

Think about all the little things that often get missed in a small business:

- Bank Fees: Those monthly service charges are a small but consistent fixed cost.

- Software Trials: You sign up for a free trial, forget about it, and suddenly you have a new monthly subscription.

- Shipping Supplies: You remembered the postage, but what about the boxes and tape? Those are variable costs tied to every order.

- Payment Processor Fees: That 2.9% + $0.30 per transaction from Stripe or PayPal is a direct, per-sale variable cost.

I once worked with a freelance entrepreneur who launched a new service package. Her business plan looked solid, but she completely forgot about payment processing fees. At the end of the month, she was floored to see her profit was nearly 3% lower than she expected. That small expense made a real dent in her business model.

A break-even analysis is only as good as the numbers you feed it. As a small business owner, do yourself a favor: go through your bank and credit card statements with a fine-tooth comb. You need to catch every single expense, no matter how small.

The Danger of Unrealistic Sales Projections

Finally, let's talk about the biggest risk for any entrepreneur: unchecked optimism. It’s so tempting to build a business plan with sales goals that look fantastic on a spreadsheet but have no basis in reality. When you base your analysis on wishful thinking, you create a false sense of security and a break-even point that’s dangerously low.

A startup I followed was launching a new app. Their business plan projected 5,000 subscriptions in their first quarter. The problem? They hadn't created a realistic marketing plan to back it up. They ended up selling just 500 subscriptions. Because their entire analysis was built on hope instead of data, they weren't even close to covering their costs and ran into serious cash flow trouble fast. The lesson is simple: ground your projections in solid market research and a marketing plan you can actually afford.

Frequently Asked Questions

Got questions? You're not alone. When a small entrepreneur first starts digging into a break-even analysis for their business plan, a few common questions always pop up. Here are some straightforward answers.

How Often Should I Run These Numbers?

Think of your break-even analysis as a living document, not a one-and-done exercise for your initial business plan. I recommend revisiting it quarterly at a minimum. If you're a new business finding your footing, doing a quick check-in monthly is even better. It keeps your business model grounded in reality.

You'll definitely want to update it anytime something big changes in your business. For instance, before you:

- Roll out a new marketing campaign

- Decide to raise or lower your prices

- Get hit with a major cost increase (like your lease going up)

- Are about to make a big purchase, like new equipment

Basically, if a key number in the formula is about to change, it's time to update the analysis in your business plan.

Can This Work for a Service Business?

Absolutely. This is a critical tool for small service-based entrepreneurs like consultants, designers, and freelancers. The trick is to define your "unit." For a service-based business model, a unit is simply your primary deliverable.

It could be an hour of your time, a single project, or a monthly retainer fee. Your variable costs are any expenses directly tied to delivering that service—things like contractor fees for a specific project or a software license you only use for one client. The logic is exactly the same: how many "service units" do you need to sell to make your business model profitable?

The key is to clearly define what one "unit of sale" looks like in your business. For a marketing consultant, it might be a single strategy document; for a web developer, it's one completed website.

What if I Sell Multiple Products?

Selling a mix of products is the norm for small businesses, but it does add one small step to your calculation. You'll need to figure out your weighted-average contribution margin to get an accurate view of your overall business model. It sounds more intimidating than it is.

First, you need a handle on your sales mix. For example, maybe 60% of your sales come from Product A and 40% from Product B. Calculate the contribution margin for each product separately. Then, just multiply each product's margin by its percentage in your sales mix and add them together. This gives you a single, blended margin you can plug right into the break-even formula.

How Does This Connect to My Marketing Plan?

This is where the magic happens for a small business. Your break-even point gives your marketing plan a concrete, must-hit target. It’s no longer about vague goals like "increasing brand awareness"—it's about generating the minimum number of sales required to make your business model viable.

You can also use it to stress-test your marketing ideas. Let's say a new ad campaign is going to cost you $500. You can quickly calculate exactly how many extra sales your marketing plan needs to deliver just to cover that $500 investment. It's a powerful way to tie every marketing dollar you spend directly to a sales outcome.

Ready to build a data-driven business plan with confidence? GrowthGrid uses advanced AI to help entrepreneurs like you create comprehensive financial projections, including break-even analysis, in under 15 minutes. Stop guessing and start planning your path to profitability today.