Trying to launch a small business without a plan is like setting off on a road trip with no map. Sure, you're moving, but you'll probably end up lost. When you create a business plan online, you're building a modern roadmap that doesn't just point to your destination—it helps you navigate the detours along the way. For small entrepreneurs with a great idea, it's the quickest way to turn that vision into a real, workable strategy.

Why An Online Business Plan Is Your Strategic Advantage

If you're running a small business or are a solo entrepreneur, your time is your most precious asset. Let's be honest, nobody has weeks to spend wrestling with a clunky Word document that will be outdated the second it's finished. Crafting your business plan online isn't just about convenience; it gives you a serious competitive edge. A digital, cloud-based plan brings immediate clarity to your business model, marketing plan, and financial projections.

This approach transforms your plan from a static, "one-and-done" document into a living, breathing guide for your small business. It becomes a tool you actually use. You'll find yourself referring to it when you're tweaking your ad budget, thinking about hiring your first employee, or just trying to stay focused on your long-term goals. It helps you see problems coming before they become disasters, allowing you to pivot smartly.

The Modern Edge Over Traditional Planning

The shift to online planning tools is part of a much bigger picture of how nimble small businesses now operate. The market for business planning software is expected to hit $7.8 billion by 2033, and cloud-based platforms already command a 55% market share thanks to their sheer flexibility. That growth tells a simple story: small entrepreneurs need tools that can keep up with them. You can dig into more business plan statistics to see just how much things are changing.

An online business plan makes you answer the tough questions about your business model and marketing from the get-go. This isn't just about getting a loan—it's about building a strong, resilient small business from the ground up.

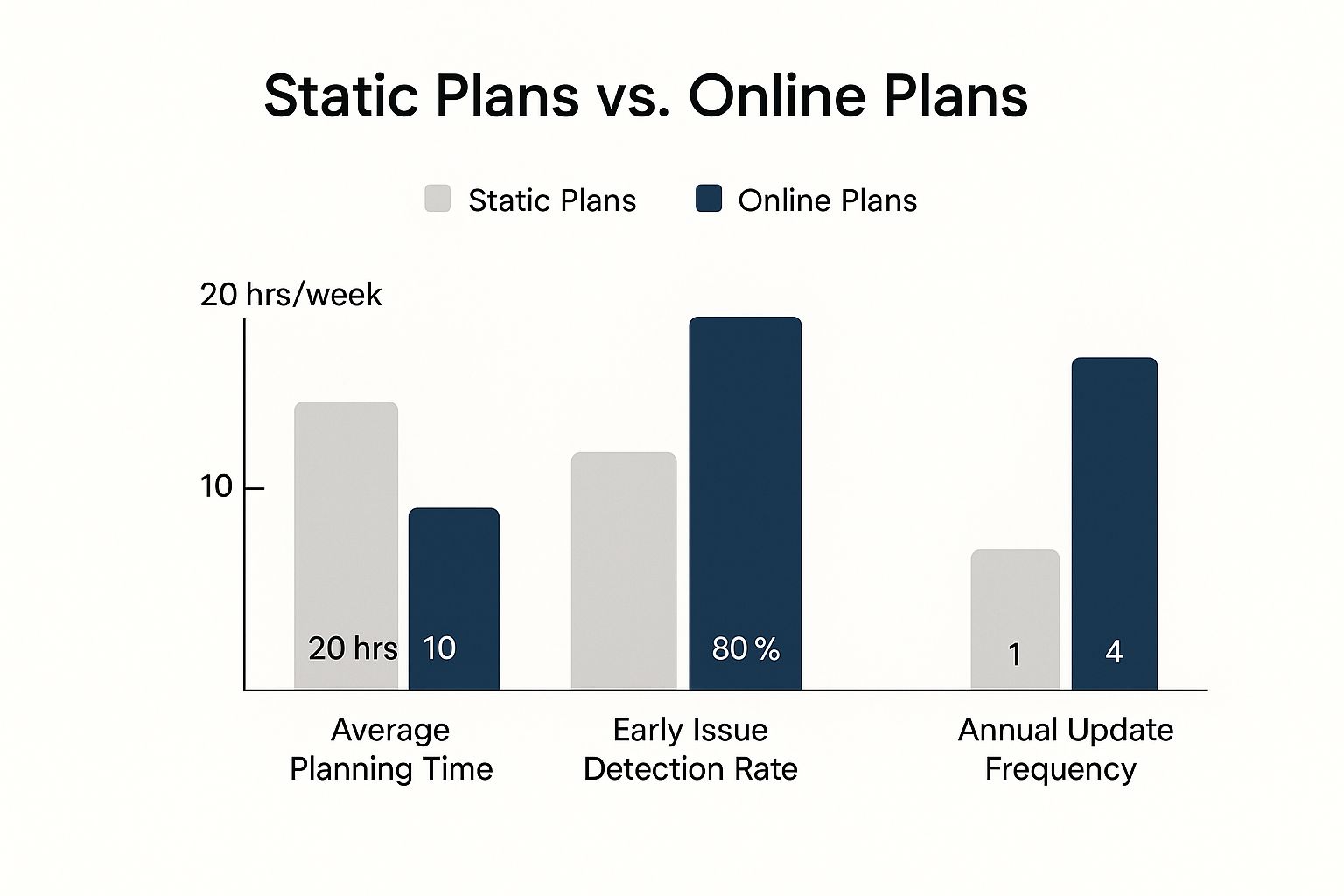

The difference in efficiency between old-school and modern planning is stark.

As you can see, using an online tool can literally cut your planning time in half and makes you almost three times more likely to spot potential problems early.

Key Benefits For Small Entrepreneurs

Choosing an online planning tool gives you practical advantages that directly affect your operations and your sanity. They are built for the real world of running a small business.

- Speed and Efficiency: You can put together a professional, well-structured business plan in a matter of hours, not weeks. This gets you from idea to action so much faster.

- Real-Time Collaboration: Forget emailing different versions of a file back and forth. You can share a single link with a co-founder, mentor, or investor to get their feedback instantly.

- Data-Driven Decisions: Most good online tools have built-in financial forecasting that does the heavy lifting for you. This gives you much clearer cash flow projections and helps you set a marketing budget that actually makes sense for your business.

- Adaptability: Your market will change. A new competitor will pop up. An unexpected opportunity will land in your lap. An online business plan can be updated in minutes, ensuring your strategy is always relevant.

Modern vs. Traditional Business Planning

It's helpful to see the differences side-by-side. Here’s how online tools are giving small businesses a huge advantage over the old way of doing things.

| Attribute | Traditional Plan (Static Document) | Online Plan (Dynamic Platform) |

|---|---|---|

| Creation Time | Weeks or even months | A few hours or days |

| Accessibility | Stuck on one computer; hard to share | Cloud-based, accessible anywhere |

| Updates | Painful and time-consuming | Quick and easy to modify in real-time |

| Collaboration | Difficult; involves tracking multiple versions | Seamless; team members work on one plan |

| Financials | Manual spreadsheet calculations | Automated projections and charts |

| Usability | Often created once and then forgotten | A living guide used for daily decisions |

Ultimately, a modern business plan is an active asset. It’s a tool that evolves with your small business, providing the clarity and direction you need to not just survive, but thrive.

Nailing Down the Core of Your Business

Before you even think about putting together a business plan online, you have to get brutally honest about your core business model. It's easy to get excited and leap right into sales forecasts and marketing budgets, but a plan built on a fuzzy concept is doomed from the start. The real work begins with defining what your small business is truly about, and that goes much deeper than a generic mission statement.

This first step is all about asking—and answering—a few tough questions. Who, specifically, are you serving? What nagging problem are you actually solving for them? And why is your solution genuinely better than what they’re already using?

A razor-sharp value proposition is the foundation of any successful small business. It’s not about what you sell; it’s about the specific relief or result you deliver to a specific group of people. Get this wrong, and your marketing plan will be aimless and your business model will lack a clear direction.

Moving From a Vague Idea to a Powerful Value Proposition

Let's make this real. A local bakery with a vague idea might say they're "selling high-quality pastries." That’s nice, but it’s not a business model.

A powerful value proposition, on the other hand, sounds like this: "We provide fresh, gluten-free sourdough bread and treats for health-conscious families in the downtown area who struggle to find safe, delicious options locally." See the difference? One is a product, the other is a solution at the heart of a small business.

Or what about a solo consultant? Instead of "offering social media management," a compelling value proposition would be "a simple, affordable social media management service for local restaurants who feel overwhelmed by platforms like Instagram and Facebook." Specificity is your superpower as a small entrepreneur.

As you start documenting these core principles, it's also the perfect time to think about your formal structure. For example, drafting a clear Memorandum of Association early on can help define the scope of your business activities from day one. You can learn more about this at https://growth-grid.ai/docs/memorandum-of-association.

Pinpointing Your Ideal Customer and Unique Edge

To get this kind of clarity, you have to climb inside your ideal customer's head. This goes way beyond basic demographics like age and location.

- What are their daily frustrations? Think about what keeps them up at night. For that restaurant owner, it’s probably the stress of not knowing how to attract new diners online.

- What do they secretly want? The customer buying from the gluten-free bakery doesn't just want bread; they want the simple joy of a family meal without the fear of an allergic reaction.

- What actually makes you different? This is your unique selling proposition (USP). What do you have that no one else does? Is it your over-the-top customer service, your specialized local knowledge, or your flexible pricing for fellow small businesses? Nail it down.

This level of detail is non-negotiable, especially when you consider that an average of 4.7 million businesses are launched each year in the US alone. In such a crowded field, a clear value proposition is how your small business gets noticed. A focused marketing plan is key, especially since 76% of shoppers will check out a company's website before ever visiting in person. Answering these foundational questions gives your entire business plan a north star to follow.

Building Your Go-to-Market Strategy

An incredible idea only becomes a business once it finds paying customers. This is where your marketing plan comes in—it’s the bridge connecting your solution to the people who need it most. When you create a business plan online, this is the part where your big vision gets translated into a practical plan for growth.

Think of your go-to-market strategy as more than just a list of marketing tactics. It’s a unified plan explaining how you'll break into the market, grab your audience's attention, and start making money. For a small business, this means being smart and putting your limited resources where they'll make the biggest splash.

Sizing Up Your Market and Competitors

First things first, you need a solid grasp of the industry you're stepping into. This starts with a straightforward market analysis. How big is the pond? You need to estimate the total addressable market—how many people could realistically buy your product? Many online planners have tools that can pull industry data to help you get a grounded number.

Once you know the market size, it's time to scope out the competition. Don't just make a list of their names. Dig deeper.

- What's their secret sauce? Analyze their marketing messages, how they engage on social media, and what customers say about them in reviews.

- Where are they dropping the ball? Maybe their customer service is notoriously slow, their pricing is a mess, or they're completely absent from a platform where your ideal customers hang out.

These gaps are your openings. Your entire goal here is to carve out a unique spot in the market that your rivals are overlooking.

A classic mistake I see small entrepreneurs make is claiming they have no competitors. Here's the truth: even if a direct one-for-one alternative doesn't exist, your potential customers are using something to solve their problem right now. That "something" is your competition.

Crafting Your Customer Acquisition Plan

With a clear picture of the market, you can start mapping out how you’ll win over your first customers. This is where you get specific about the channels in your marketing plan. For most small entrepreneurs starting out, high-impact, low-cost channels are your best bet.

I'd recommend starting with a mix of these:

- Targeted Social Media Campaigns: Don't try to be everywhere at once. Pick the one or two platforms where your ideal customer lives. If you're a B2C brand, that might be Instagram or TikTok. For a B2B service, it’s almost certainly LinkedIn.

- Local SEO: If you have a storefront or serve a specific city, optimizing your Google Business Profile and local website pages is a non-negotiable for getting found by nearby customers.

- Content Marketing: Start a blog, create how-to videos, or launch a niche podcast. When you provide real value upfront, you build trust and naturally attract people who are already looking for the solutions you offer.

Let's make this real. A small e-commerce brand selling handmade candles used an online planner to define its marketing plan and allocate its budget. They put 70% of their starting funds into highly targeted Instagram ads and the other 30% into a blog focused on home decor tips. This focused approach paid off, leading to a 150% jump in sales in their first year.

If you really want to go deep on this topic, I’d recommend checking out this complete guide to Go-to-Market Strategy for Startups, which breaks down exactly how to launch a new product effectively.

Making Sense of Your Financial Story

https://www.youtube.com/embed/RnRKE-_WHd0

Let's be honest—for most small business owners, the financial section of a business plan is where the anxiety kicks in. This is the moment where your big ideas have to stand up to the cold, hard reality of numbers. But it doesn't have to be intimidating.

The goal isn't to suddenly become a certified accountant. It's about telling a convincing, realistic story of how your small business will actually make money and sustain itself.

When you create a business plan online, you're not just staring at a blank spreadsheet anymore. Modern tools walk you through the entire process, breaking down what used to be complex financial wizardry into simple, guided steps. You'll figure out your startup costs, map out your first year of sales, and see your profit and loss statement come to life.

Projecting Your Startup Costs and Revenue

Before you can dream about profits, you have to get a firm grip on your startup costs. You need a clear list of every single expense required to get your small business off the ground, whether you have a physical storefront or are purely online.

Think about two main categories of costs:

- One-Time Expenses: These are the initial hurdles. Think business registration fees, paying a designer for your website, buying that first batch of inventory, or setting up your home office.

- Recurring Monthly Costs: These are the bills that will show up every month like clockwork—software subscriptions, rent, marketing services, and utilities.

Once you know what you'll be spending, you can start thinking about revenue. The biggest trap here is wild optimism. A new freelance consultant, for instance, shouldn't just pencil in $10,000 a month from day one. A much more realistic forecast would be to land one client in the first month, maybe two in the second, and then build from there based on your marketing plan.

Your financial projections are a narrative. They should logically follow the story you’ve told in your marketing and operations sections. If your marketing plan calls for a big ad campaign in month three, your sales forecast should reflect a corresponding bump.

Building Your Key Financial Statements

A strong financial plan really comes down to three key documents. They don't work in isolation; together, they paint a complete picture of your company's financial health. An online planner does the heavy lifting, taking the numbers you provide and formatting them into the professional reports that investors and lenders expect to see.

It's helpful to understand what each of these core statements really tells you.

Key Financial Statements for Your Plan

A breakdown of the essential financial documents and the story each one tells about your business.

| Financial Statement | What It Reveals | The Core Question It Answers |

|---|---|---|

| Income Statement | Your profitability over a specific period, like a quarter or a full year. | "Is my business actually making a profit?" |

| Cash Flow Statement | The actual movement of cash in and out of your business. | "Do I have enough cash on hand to pay my bills?" |

| Balance Sheet | A snapshot of your assets, liabilities, and equity at a single point in time. | "What is the overall financial health of my company?" |

A clear financial picture isn't just about revenue. It's also about understanding the real cost of getting customers, which means calculating your Customer Acquisition Cost (CAC) is non-negotiable for proving your business model is sustainable.

This process gives you the clarity to make smarter, more confident decisions. It's very similar to the deep analysis you'd perform when running a feasibility study, which is all about making sure your great idea is also a financially viable one.

Pulling It All Together: Assembling Your Final Business Plan

You’ve done the heavy lifting. The business model is solid, you’ve hammered out a marketing plan, and the financial projections are complete. Now it’s time to weave all those separate threads into a single, compelling story. This is the moment where an online tool like GrowthGrid really shines, helping you transform a collection of ideas into a professional document that’s ready for prime time.

Don't think of this as just a copy-and-paste job. This final step is about creating a seamless narrative. You want to draw a clear, logical line from the market opportunity you've identified, through your unique solution and marketing plan, and all the way to your financial forecasts. The goal is to leave no doubt that you've meticulously considered every angle of your small business.

Nail the Executive Summary: Your First Impression

Though it's the last thing you'll write, the executive summary is the very first thing anyone will read. Think of it as the ultimate elevator pitch for your entire business plan. It has to grab their attention immediately.

I see so many small entrepreneurs make the mistake of writing a summary that’s either too long or filled with vague jargon. Your summary needs to be a tight, powerful highlight reel of your entire plan, ideally fitting on a single page.

Here’s what you absolutely have to include:

- The Problem: What specific gap in the market are you addressing? Be crystal clear.

- Your Solution: Sum up your product or service in one killer sentence.

- Target Market: Who is your ideal customer? Paint a quick picture.

- Financial Highlights: Mention key numbers, like projected first-year revenue or your break-even point.

- The Ask: If you’re looking for funding, state exactly how much you need and what it’s for.

I always tell people to think of their executive summary like a movie trailer. It needs to be exciting and intriguing, giving just enough information to make someone want to see the whole film without spoiling the plot. This is your best shot at making a lasting impression.

Finalizing Operations and Polishing Your Presentation

With a killer summary drafted, it's time to lock down the operational details. This is where you explain the nuts and bolts of how your small business will actually run day-to-day. Are you a solopreneur working from home, or will you need a small team and a storefront? Map out your supply chain, the technology you’ll rely on, and any key personnel.

Finally, don’t underestimate the power of presentation. A professionally designed plan that reflects your brand’s look and feel sends a powerful message. It shows you’re serious and have an eye for detail. Most online platforms let you easily add your logo, customize the design, and export a polished PDF that looks fantastic. This visual polish is what ties everything together.

Before you send it to anyone, proofread it obsessively. Then have a trusted friend or mentor read it. A fresh pair of eyes can spot typos and find areas that need more clarity. Once it's ready, you'll have more than just a document—you'll have a clear roadmap to bring your vision to life. For some great examples on how to structure the final document, check out the templates included in our small business starter pack.

Got Questions About Online Business Plans? Let's Clear Things Up.

Diving into a business plan for the first time can feel a bit overwhelming, and it's totally normal to have questions. Small business owners and entrepreneurs often ask the same things when they start this process. Let's tackle some of the most common ones so you can move forward with confidence.

How Long Should My Business Plan Be?

Let’s bust a big myth right now: you do not need a 100-page business plan. In my experience, a lean and focused plan of 15-25 pages is usually perfect for most small businesses and startups. Anything longer, and you risk it gathering dust on a shelf.

The real goal isn't hitting a page count; it's about clarity and creating a practical guide. Online tools are fantastic for this because they naturally keep you focused. They guide you through the essentials of your business model and marketing strategy without letting you get bogged down in fluff. Think of it as your strategic playbook, not an encyclopedia for your small business.

Can I Really Write a Business Plan Without Hiring an Expert?

Yes, you absolutely can. And honestly, for a small entrepreneur, you probably should. Modern online platforms are designed for founders like you, not CPAs or business consultants. You bring the vision; the tool provides the structure.

These platforms act like a co-pilot, walking you through each section with helpful prompts and real-world examples. The best part? The financial calculators do all the heavy lifting for you. You can create a polished, professional document entirely on your own. This not only saves you thousands of dollars in consultant fees but also forces you to deeply understand every nut and bolt of your business.

The real value isn't just the finished document—it's the process of creating it. Writing the plan yourself makes you answer the tough questions about your market, operations, and money. That exercise alone is priceless for any small business entrepreneur.

How Often Should I Update My Business Plan?

Your business plan should be a living, breathing document, not a "set it and forget it" task. Think of it as a roadmap you glance at regularly to make sure your small business is still heading in the right direction.

For most businesses, a quarterly review is a great cadence. It’s the perfect opportunity to see how your actual performance stacks up against your forecasts and make tweaks to your business model or marketing plan.

Of course, you'll also want to update it after any major business event. These could include:

- Launching a significant new product or service.

- Expanding into a new market.

- Closing a round of funding.

- Pivoting your strategy because of a major industry shift.

This is where an online plan really shines. You can hop in, make adjustments in minutes, and keep your strategy aligned with what’s happening on the ground. It ensures your plan remains a genuinely useful tool for growth.

Ready to turn that brilliant idea into a concrete, actionable strategy? With a tool like GrowthGrid, you can get a personalized, professional business plan done in under 15 minutes. It’s time to stop wondering and start building. Get started with GrowthGrid today!