An executive summary for a business plan is your entire small business distilled into a single, powerful snapshot. Think of it as the ultimate one-page pitch, crafted to grab a lender's or local investor's attention and convince them your small business is the real deal.

Your One-Page Pitch to Lenders and Partners

For small entrepreneurs, the executive summary isn't just a part of the business plan—it's the most critical part. It’s often your first and only opportunity to make a lasting impression on the people who can fund your dream, whether that's a bank manager or a local investor. More than a simple introduction, this is a strategic tool that immediately signals your venture's viability and your own professionalism.

Essentially, your summary is the elevator pitch on paper. It needs to hook the reader with your core business idea, the untapped local market opportunity you've uncovered, and the key financial highlights that prove your business model works. A great summary doesn't just inform; it makes them excited to turn the page and learn more about your marketing plan and operations.

The Power of a Strong First Impression

A well-written executive summary does all the heavy lifting upfront. It takes your entire marketing plan, operational strategy, and financial projections and boils them down into a compelling, easy-to-digest narrative. It's your chance to show you have a clear, credible path to success that’s worth their time and, more importantly, their money.

The hard truth for most small business owners is that if the executive summary fails to impress, the rest of the business plan will likely never get read. It has to be clear, confident, and persuasive enough to stand completely on its own.

The exercise of writing a summary also forces you to sharpen your own vision. Research has shown that entrepreneurs who develop a detailed business plan, complete with a thoughtfully crafted executive summary, are 16% more likely to succeed than those who don't. It’s a testament to the power of solid, strategic planning for any small enterprise.

What Makes a Summary Effective

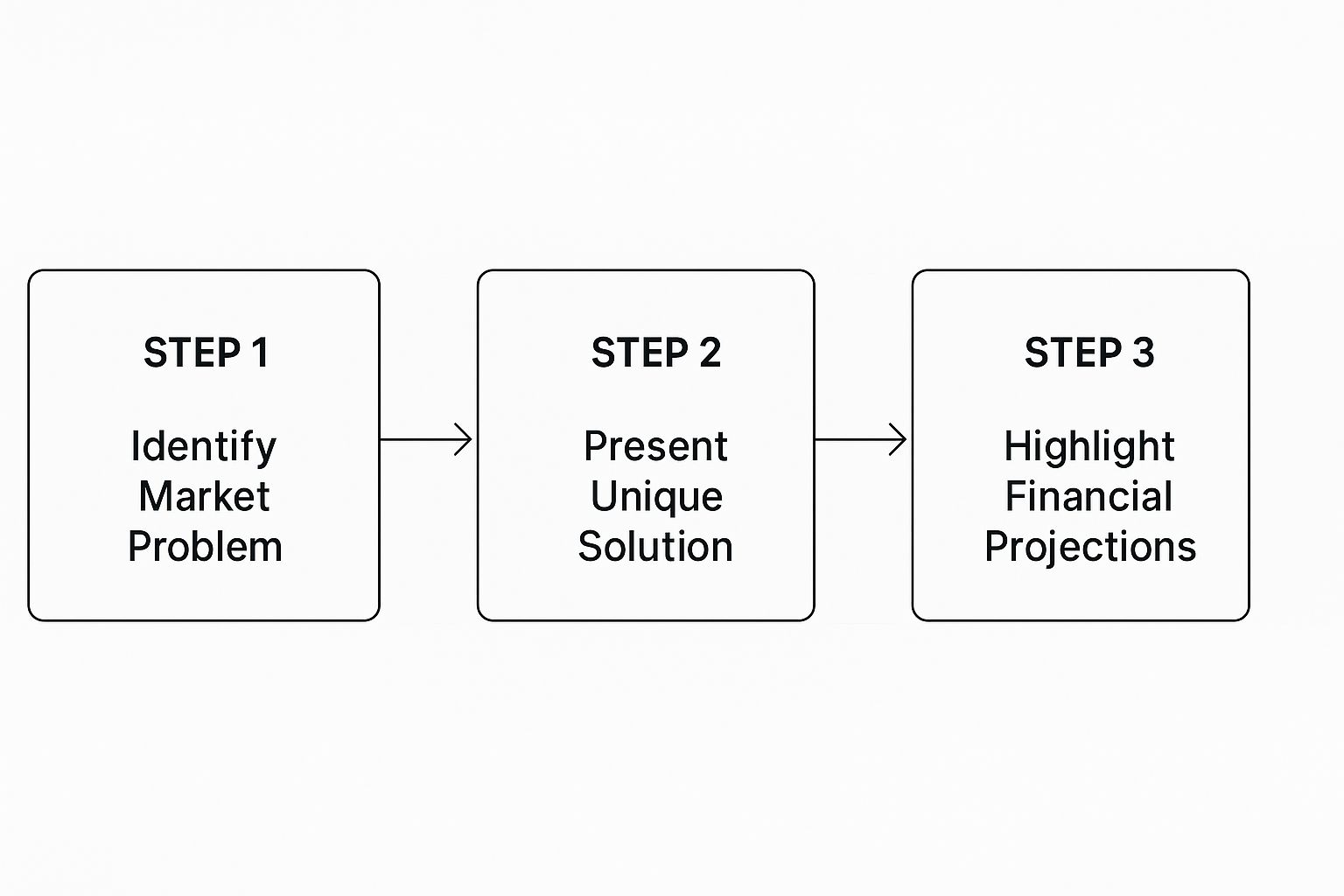

A truly effective summary isn't just a roadmap of your business plan; it tells a compelling story. It should walk the reader from the problem you're solving for your community to the profit you plan to generate. To get this right, it pays to study proven strategies for writing executive summaries that win deals.

To give you a better idea of what to include, here’s a quick breakdown of the core components every loan-ready summary needs.

Core Elements of a Small Business Summary

| Component | What It Achieves | Key Information to Include |

|---|---|---|

| Mission & Vision | Sets the stage and grabs attention. | Your company’s purpose and the problem you solve for customers. |

| Market Opportunity | Shows the potential for growth. | Size of your target market, local trends, and your ideal customer profile. |

| Products & Services | Explains your core offering. | What you sell and what makes it unique or better than local competitors. |

| Financial Highlights | Proves the business model is sound. | Key revenue projections, profit margins, and startup or expansion costs. |

| The Ask | Clearly states your funding needs. | The loan or investment amount required and how it will be used. |

Remember, your goal is to make it easy for potential backers to see the value in what you’re building. For a practical example, take a look at our detailed business plan sample for a coffee shop at https://growth-grid.ai/samples/coffee-shop to see how these pieces fit together in a real-world scenario.

Building the Key Sections of Your Summary

https://www.youtube.com/embed/fnOrZQP0TlI

Alright, let's move from theory to action. A truly compelling executive summary isn't just one big block of text; it's built from several distinct, powerful components. Think of each section as telling a crucial part of your small business's story, guiding the reader from a problem they recognize to a solution they can get behind.

For any small entrepreneur, getting these elements right is everything. If you're looking for more tips on making your summary pop, this guide on how to create an engaging executive summary has some great ideas for capturing and holding attention.

Nail the Market Problem

Every great small business starts by solving a real problem for a specific group of people. This is your hook. You need to clearly articulate the pain point your target customers are dealing with every day.

Don't be vague here. Use local data or a relatable scenario to show that this isn't just a minor inconvenience—it's a significant, urgent need just waiting for the right solution.

For example, a new catering business might see that local offices struggle to find healthy, affordable lunch options for their employees. Most rely on fast food or expensive restaurants, leading to low morale and high costs. That’s a problem that’s specific, measurable, and instantly understood by a local lender.

Present Your Unique Solution

Once you’ve set the stage with a clear problem, it's time to introduce your product or service as the hero of the story. Explain what you do, but more importantly, explain why it’s a better fix than anything else out there. This is where you have to show off your unique value proposition.

Let's stick with our catering example. Their solution could be a subscription-based lunch delivery service for local businesses. The "unique" part is their business model: a weekly menu of fresh, locally-sourced meals delivered directly to the office at a flat per-employee rate. This directly solves the pain point of unhealthy, inconvenient lunches.

Following this kind of structured narrative ensures your summary tells a logical and persuasive story, connecting all the dots for your reader.

Detail Your Market and Competitive Edge

So, who are you actually selling to, and why are you the one who's going to win their business? You need to define your target market with absolute precision. "Everyone" is not an answer. Instead, get specific with your ideal customer profile—something like "small to mid-sized professional offices with 10-50 employees within a 5-mile radius."

Next, you have to showcase your competitive advantage. What's your secret sauce? What's going to protect you from other local competitors? This could be anything from a unique recipe, an exclusive partnership with a local farm, or a superior customer service model. This section proves you’ve done your homework and have a defensible marketing plan. If you need to dig deeper into this, our guide on conducting a https://growth-grid.ai/docs/feasibility-study can help you validate your market position.

A classic mistake I see is entrepreneurs claiming they have "no competition." That's a massive red flag for any lender. It usually means one of two things: either you haven't done enough research, or there's no real market for what you're selling.

Showcase the Team and Financials

At the end of the day, an idea is only as good as the people bringing it to life. Briefly introduce yourself and any key team members, highlighting the specific experience that makes you the right people for this venture. If you're a chef with 15 years of experience or have a partner who is a local marketing expert, now's the time to mention it.

Finally, your financial projections are the proof that your business model is not just a nice idea, but a profitable one. Give a quick snapshot of the key numbers:

- Projected Revenue: A clear forecast of your sales over the next three years.

- Key Milestones: What are the major targets you need to hit? Think securing your first 10 corporate clients or reaching $10,00__ in monthly recurring revenue.

- The "Ask": Be direct. State exactly how much funding you need and what you're going to spend it on to hit those milestones.

Crafting a Compelling Business Narrative

Alright, let's get down to the brass tacks of actually writing this thing. The single biggest mistake small entrepreneurs make is trying to write their executive summary first. It feels like the logical place to start, but it's a trap.

Think of it this way: how can you possibly summarize a plan that doesn't exist yet?

The only way to do it right is to write it last. Once your full business plan is complete—including your marketing plan, operations, and financials—you have all the key information right in front of you. This makes writing the summary less about guessing and more about distilling the most potent parts of your work into a compelling, coherent story.

We'll walk through how to take that finished plan and weave its threads—your mission, your unique value, and your financial projections—into a narrative that grabs a reader and logically guides them from the problem you're solving to your profitable solution.

Articulating Your Mission and Value

Your mission statement is not the place for corporate jargon. It's your "why." For a small business, this is the soul of your company, the reason you get out of bed in the morning. It’s your first chance to make a real, human connection with your reader before you hit them with the numbers.

For instance, a local bakery's mission isn't just "to sell high-quality baked goods." That's what you do, not why you do it. A better mission might be, "To be the heart of our community, crafting wholesome bread and pastries that bring people together." One is a description; the other is a story.

A powerful value proposition answers one simple question for the customer: "What's in it for me?" If your executive summary can’t answer that in a few seconds, you've already lost their interest.

When you state your value proposition, it needs to be crystal clear. This is the promise you’re making to your customers.

- Get Specific: Don’t say "high-quality." Say "handcrafted from organic, locally-milled flour."

- Show the Benefit: Instead of just listing what your product does, explain how it makes a customer's life better or solves a nagging problem for them.

- Draw a Line in the Sand: What makes you the obvious choice over your competitors? Are you faster? Cheaper? More ethical? More convenient? Spell it out.

Highlighting Key Financials Without Overwhelming

Talking about money in an executive summary business plan is a balancing act. You need to show that your small business is a viable, money-making machine, but you don't want to bury your reader in a sea of spreadsheet data. The goal here is a snapshot, not a full-blown financial audit.

You're looking for a few high-level numbers that tell a story of growth and profitability. Any potential lender or partner wants to see that you've done the math and have a realistic path forward.

Stick to the headline figures:

- Revenue Projections: A simple, three-year forecast is standard. (e.g., Year 1: $75k, Year 2: $150k, Year 3: $250k).

- Major Milestones: What are the big wins you're aiming for? This could be signing up your first 50 regular customers, securing a lease on a new location, or hitting profitability.

- Profitability Timeline: Be upfront about when you expect to break even and start turning a profit.

This is all you need to show that your great idea is also a sound investment.

Stating Your 'Ask' with Confidence

Here we are—the grand finale of your summary. You’ve laid out the problem, presented your brilliant solution, and shown that it’s financially viable. Now, you have to tell them what you need. This is no time to be shy or vague.

Being direct and specific about your "ask" signals that you have a clear plan for how you'll use the capital.

Whether you need a small business loan or a local investment, spell it out. Don't just ask for $50,000. Ask for $50,000 to accomplish something specific.

A weak ask sounds like this: "We are seeking funding to grow the business."

A strong ask sounds like this: "We are seeking a $50,000 small business loan to purchase a new commercial oven and launch a targeted local marketing campaign, with the goal of increasing our daily sales by 40% within 12 months."

See how the strong ask ties the money directly to the milestones you've already mentioned? It shows a lender exactly where their money is going and what kind of return they can expect. It closes your story with a clear call to action and a roadmap for success.

Avoiding Common Mistakes That Kill Deals

Knowing what not to do in your executive summary is just as critical as knowing what to include. I’ve seen countless solid business plans get tossed aside because of a few simple, unforced errors in the first two pages. These are the red flags that lenders and investors are practically trained to spot from a mile away.

Think of it this way: your executive summary is the gatekeeper to your full business plan. If it’s confusing, vague, or looks amateurish, that gate will slam shut before anyone even peeks at the brilliant work you’ve put into the rest of the document. The good news? These mistakes are entirely preventable.

Mistake #1: Being Too Long or Too Vague

The single most common mistake is length. An executive summary is supposed to be a tight, powerful snapshot, not a novel. When I see one that rambles on for five pages, it tells me the small business owner can't distill their own business down to its core—a major concern for any potential partner.

Just as damaging is being vague about your business model. You simply cannot afford to be mysterious about how you make money. Lenders need to see a clear, direct path to revenue, not a bunch of fluffy statements.

Before: "We will generate revenue from our services and build a strong customer base."

After: "Our revenue model is based on two core services: a $45 standard haircut and a $120 premium color treatment, supplemented by a 15% margin on retail hair care products."

See the difference? The "after" example is specific, direct, and leaves no room for confusion. It shows you've actually thought through your business's financial strategy.

Mistake #2: Drowning in Jargon and Forgetting the Ask

Every industry has its own lingo, but your executive summary needs to connect with a general business audience, like a bank loan officer. Overloading it with technical acronyms and niche jargon is a surefire way to alienate readers who aren't deep in your world. Your goal is clarity, not to show off how much you know.

A confused lender never approves a loan. If they have to Google your terminology, you’ve already created a barrier. Stick to plain, direct language that anyone can understand.

Finally, and this one always surprises me, people often forget to state their "ask" clearly. After building a compelling case for your business, you have to explicitly state what you need. Don't make them guess how much funding you're looking for or what you'll do with it.

- Weak Ask: "We are seeking funding to support our growth."

- Strong Ask: "We are seeking a $75,000 business loan to fund the build-out of our new retail location and purchase initial inventory."

Meticulous planning really is the key to long-term success. While 80% of small businesses make it past their first year, stats show that only about 34.4% are still around after 10 years. You can learn more about small business survival rates and see how solid planning makes all the difference. Avoiding these simple mistakes puts the odds much more in your favor.

Using Modern Tools to Sharpen Your Plan

Gone are the days of building a business plan entirely from scratch on a blank document. A whole suite of powerful software and digital tools now exists to help you organize your strategy, crunch the numbers, and produce a professional, lender-ready executive summary far more efficiently.

These platforms are a world away from a simple word processor. They offer structured templates that act as a guide, making sure you don't miss any critical components, from market analysis to financial forecasting. For a small business owner, that kind of structure is a godsend—it prevents you from overlooking the very details lenders are trained to look for.

Simplify Your Financial Forecasting

Let's be honest, financial projections can be a headache. This is where modern tools really shine. Instead of getting tangled up in complex spreadsheet formulas, you can plug in your core assumptions—like sales projections and costs—and the software will generate clean, professional-looking charts and statements. This presents your financial data with total clarity, making it much easier for potential backers to understand your business model.

It's a trend that's catching on fast. The market for business plan software is actually projected to double by 2032, jumping from $1.5 billion to a staggering $3 billion. This just goes to show how much small and medium-sized businesses are leaning on technology to sharpen their strategic planning. You can discover more insights about these business planning trends on upmetrics.co.

Collaborate and Refine Your Strategy

Many of these platforms are also built for teamwork. They often include collaborative features that let you get real-time input from mentors, advisors, or your own team members right inside the document. For any small entrepreneur, that feedback loop is priceless. It lets you pressure-test your assumptions and fine-tune your marketing plan long before it lands on a lender’s desk.

Using these tools helps transform your executive summary business plan from a static document into a dynamic blueprint. It becomes a living plan that can be easily updated as your business evolves, ensuring it remains a relevant guide for your venture’s growth.

Answering Your Top Questions

Even with a solid framework in hand, a few questions always pop up when you're putting the finishing touches on something as critical as an executive summary. I see these come up all the time with small entrepreneurs. Let's clear up some of the most common uncertainties so you can finalize your business plan with total confidence.

How Long Should an Executive Summary Be?

The golden rule here is brevity. Seriously, keep it tight. You’re aiming for a powerful, easy-to-digest snapshot that shows you respect a lender's time.

A good rule of thumb is to keep it between 5-10% of your business plan's total length. In most cases, that works out to be one, maybe two pages—max. If you can't hook them and explain your core business in that space, it might be a red flag that your overall strategy isn't focused enough.

Should I Write the Executive Summary First or Last?

This one trips up so many people, but the answer is simple: Always write it last.

I know, it’s the first thing someone reads, so it feels like you should write it first. But think about it—it’s a summary of the entire plan. You can't possibly summarize a document that doesn't exist yet. Nail down all the details of your marketing plan, operations, and financials first. Once that's done, you'll have all the juicy data points and key highlights you need to distill into a compelling summary.

What Is the Single Most Important Element to Include?

If I had to tell you to get one thing absolutely perfect, it's this: a crystal-clear, compelling description of the problem you're solving and your unique solution. This is your hook. It’s what grabs a reader from the first sentence and makes them care.

A lender needs to immediately understand the customer’s pain point and see exactly why your product or service is the best possible fix. This core value proposition is the foundation for everything else, from your marketing plan to your financial forecasts.

The real power of an executive summary is its ability to tell your entire story in miniature. It needs to stand on its own and convince someone of your venture's potential, even if they never read another word.

As you finalize these details, you might find other questions popping up. For more answers to common hurdles, feel free to explore our full list of frequently asked questions for business owners.

Your executive summary is your business's first handshake. By keeping it short, writing it at the end, and nailing your core value proposition, you create a powerful document that doesn't just get read—it opens doors.

Ready to create a professional, investor-ready business plan in minutes? GrowthGrid uses advanced AI to build a comprehensive plan tailored to your small business. Answer a few simple questions and get your complete plan, from the executive summary to financial projections, saving you time and money. Start your business plan with GrowthGrid today