So, what's the magic number for a small business plan's length? Every entrepreneur asks this, but the real answer isn't a single number. That said, a great target for most small businesses is somewhere in the 15 to 25 page range.

This length hits the sweet spot. It's concise enough to keep a busy reader engaged but detailed enough to paint a clear picture of your vision, your market, and your path to success.

The Real Answer to Your Business Plan's Length

Stop thinking about page count and start thinking about purpose. A business plan isn't a book report; it's a communication tool. For a small entrepreneur, its job is to tell a compelling, convincing story about your business, whether you're trying to get a bank loan or get your small team rowing in the same direction.

Your audience dictates the level of detail you need.

- For your internal team: A shorter, punchier plan that focuses on your business model, goals, and marketing plan works just fine.

- For a bank loan: Lenders will pour over your financial projections and risk assessments. You need to be thorough here.

- For investors: Venture capitalists want to see massive market opportunities, a scalable business model, and a killer executive team.

Business Plan Length at a Glance

To give you a better starting point, here's a quick cheat sheet that breaks down common business plan types and their typical lengths based on who you're writing for as a small entrepreneur.

| Plan Purpose | Typical Audience | Recommended Page Count |

|---|---|---|

| Internal Strategy | Founder, Team Leads | 10-15 pages |

| Bank Loan Application | Loan Officers, Credit Committees | 20-30 pages |

| Investor Pitch | Angel Investors, Venture Capitalists | 15-25 pages |

| Startup/Lean Plan | Founder, Early-Stage Partners | 1-10 pages |

Remember, these are just guidelines. The complexity of your business model will always be the biggest factor in determining the final length.

Ultimately, your goal is to be comprehensive without being overwhelming. According to a survey by Growthink, a plan between 15 and 25 pages is considered optimal by most professionals. It’s just enough detail to get investors excited without bogging them down in fluff. A plan that’s too short might look like you haven't done your homework.

Crafting a document that hits all the right notes can be challenging, and sometimes getting a local perspective is invaluable. Working with local business plan services can give a small entrepreneur that extra edge.

What Really Dictates Your Business Plan's Page Count?

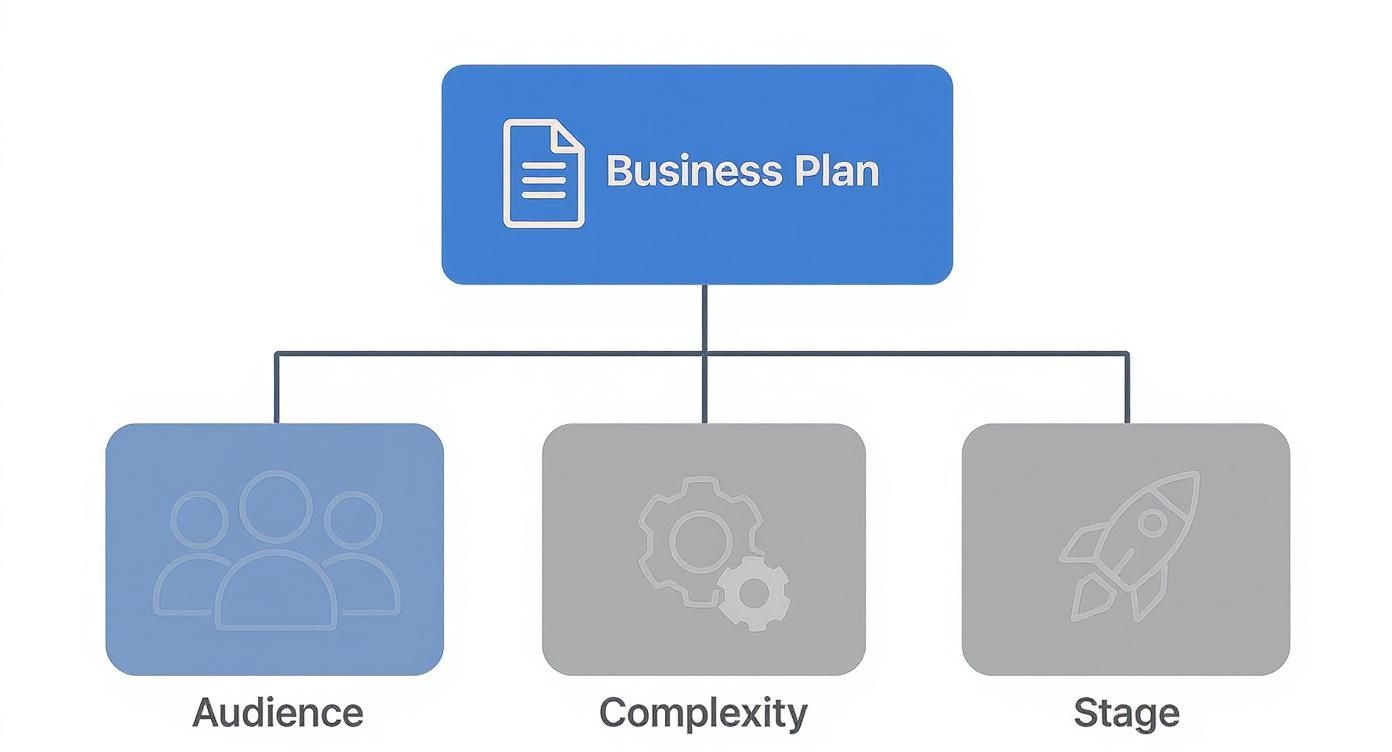

Forget the idea that there's a magic number for your business plan's length. The truth is, it's not a one-size-fits-all situation. The final page count for a small business really boils down to three key things: who you're writing it for, how complex your business model is, and where you are in your journey.

Nailing these down will tell you whether you need a lean, 10-page powerhouse or a more detailed 30-page blueprint.

First up, think about your audience. You need to tailor the story you're telling to the person reading it, because they all care about different things.

- Bankers and Lenders: These folks are all about risk. They want to see that you've done your homework and can pay back the loan. That means your plan needs rock-solid financial projections and a clear breakdown of how every dollar will be spent. This usually leads to a longer, more data-heavy document.

- Venture Capitalists (VCs) and Investors: VCs are hunting for the next big thing. They want to see huge growth potential. For them, you'll want to highlight the market size, what makes your business model different, and why your team is the one to make it happen. It can be shorter, but it has to be incredibly persuasive.

- Internal Teams: This is your internal roadmap. It’s for you and your crew, so it can be much leaner. The focus here is on the nuts and bolts: operational goals, marketing plans, and the metrics you'll be tracking.

Your Business Model and Current Stage

Next, how complicated is your business model? A plan for a neighborhood coffee shop is going to look a lot different from one for a tech startup building a brand-new SaaS platform. The more moving parts you have—whether in your operations, supply chain, or technology—the more you’ll need to explain.

Sometimes, a detailed preliminary assessment, like what you’d find in a feasibility study for a new venture, can help you map out these complexities before you even start writing the full plan.

Finally, where you are on your entrepreneurial journey is the last piece of the puzzle. An established small business looking to expand can lean on its track record and historical data, which might actually make the plan shorter. A startup, on the other hand, is building its case from the ground up and needs to back everything up with deep market research and detailed forecasts, which naturally adds more pages.

As a general rule, most business plans for small businesses land somewhere between 10 to 20 pages.

That said, a tech company might need extra room to detail its product and market analysis, while a straightforward service business can often get its point across in 15 pages or less. If you're curious, you can find more insights into plan lengths for different businesses on efinancialmodels.com.

Building Each Section to the Right Size

Knowing the magic number for your total page count is a good start, but the real trick for a small entrepreneur is figuring out how to slice up the pie. Think of it like building a house—each room needs to be the right size for its purpose. If the foundation (your market analysis) is just a tiny crawlspace, the whole structure is at risk.

A classic mistake I see entrepreneurs make is getting completely carried away with one section while skimping on another. They’ll write 10 pages waxing poetic about their product's features but then scribble a single paragraph for their marketing plan. That creates a lsided, unconvincing document that tells an incomplete story.

This infographic hammers home the core ideas we've been talking about—how your audience and business model complexity should dictate the final length.

As it shows, the right length is all about context. It’s a direct reflection of your audience, your business model’s complexity, and where you are on your journey.

Balancing Each Component

So, how do you build a well-proportioned plan? Let's break down the essential components and their recommended lengths. Remember, these are guidelines, not gospel. To see how these pieces click together in the real world, check out this sample business plan for a coffee shop; it’s a great way to get a gut feeling for the right balance.

To give you a clearer roadmap, here’s a table breaking down how much space to dedicate to each part of your plan.

Recommended Length for Each Business Plan Section

| Business Plan Section | Key Focus | Suggested Length (Pages) |

|---|---|---|

| Executive Summary | Your elevator pitch on paper—sharp, compelling, and concise. | 1–2 |

| Company Description | Who you are, what you do, and the core problem you solve. | 1–2 |

| Market Analysis | Proving you deeply understand your industry, customers, and competition. | 2–4 |

| Organization & Management | Introducing your key team members and their expertise. | 1–2 |

| Products or Services | Detailing what you sell and why it’s valuable and unique. | 2–3 |

| Marketing & Sales Strategy | Your specific marketing plan for reaching and converting customers. | 2–4 |

| Financial Projections | The numbers: income statements, cash flow, and balance sheets. | 3–5 |

Think of this table as your blueprint. Sticking to these general page counts helps ensure every part of your business model gets the attention it deserves.

Here’s a closer look at what goes into each section:

-

Executive Summary (1–2 pages): This is your big first impression. It needs to be a punchy, can't-put-it-down summary of the entire plan. Pro tip: Write it last, but put it first.

-

Company Description (1–2 pages): Get straight to the point. Who are you, what’s your mission, and what’s your legal structure? Most importantly, what pain are you solving for your customers?

-

Market Analysis (2–4 pages): This section needs some real meat on its bones. It's where you prove you’ve done your homework on the industry, your target audience, and the competition. Use hard data to back up claims about market size and potential.

Your goal isn't to fill pages but to demonstrate a clear understanding of the landscape. A focused two-page analysis backed by solid research is far more powerful than a five-page summary of generic industry trends.

-

Organization and Management (1–2 pages): Time to introduce the team. For a small entrepreneur, this might just be you, but it's where you spotlight the key players and show investors you have the right people to make it all happen.

-

Products or Services (2–3 pages): Detail what you’re selling. But don’t just list features—focus on the value you deliver and what makes your offering a no-brainer compared to the alternatives.

-

Marketing and Sales Strategy (2–4 pages): How will you connect with your market and turn prospects into paying customers? This is your marketing plan. Be specific about your channels, tactics, and budget. No fluff here.

-

Financial Projections (3–5 pages): For any lender or investor, this is the main event. It should include your income statements, balance sheet, and cash flow projections. Your numbers must be realistic and backed by clear, defensible assumptions. Understanding essential cash flow forecasting methods is non-negotiable for getting this section right.

Why a Readable Plan Is Better Than a Short One

It's so easy to get hung up on the "perfect" page count. I see small business owners do it all the time. But honestly, you're asking the wrong question. It's not about "how long should it be?" but rather, "how readable is it?"

Clarity will always, always win over some arbitrary page limit.

Think of your business plan as an invitation—a look inside your vision for the future. A dense, 20-page document packed with wall-to-wall text is a pretty terrible invitation. It’s a chore to get through. A well-structured 30-page plan that uses smart formatting, on the other hand? That respects the reader’s time and actually gets your point across.

Your goal is to make your key points impossible to miss. A busy investor or loan officer needs to be able to skim your plan in a few minutes and instantly get the gist of your business model, the market opportunity, and your financial projections.

Make Your Business Plan Easy to Skim

Strategic formatting is your secret weapon here. It helps break down all that complex information into bite-sized pieces, making everything from your marketing plan to your financial forecasts so much easier to follow.

Here are a few simple tricks to make your plan way more readable:

- Use Short Paragraphs: Seriously, just one or two sentences per paragraph. It creates white space and gives the reader’s eyes a break.

- Leverage Bullet Points: Lists are perfect for highlighting features, competitive advantages, or key milestones. They’re a breeze to scan.

- Incorporate Visuals: Why describe your revenue growth in a long paragraph when a simple chart can show it in seconds? It’s far more impactful.

A 20-page business plan filled with dense blocks of text is typically more difficult to digest than a 35-page plan that makes effective use of bullet points, charts, graphics, and white space. Investors often allocate only about 15 minutes to skim a plan, making accessibility critical. You can learn more about crafting a skimmable business plan from the experts at LivePlan.

At the end of the day, a longer, well-organized plan that tells a compelling story is infinitely better than a short one nobody can be bothered to read. Your plan’s design should guide your reader, not challenge them.

How to Adapt Your Plan for Different Audiences

One of the biggest mistakes I see small entrepreneurs make is creating a single "master" business plan and firing it off to everyone. But here's the reality: a banker, a venture capitalist, and your own team are all wearing different hats and looking for completely different things.

Getting to a "yes" means speaking their language.

Think of your core business plan as the complete, unabridged architect's blueprint. You wouldn't hand the entire chaotic stack of drawings to the electrician; you'd give them the electrical schematic. The same principle applies here. You’re not rewriting the whole thing each time, just strategically shifting the spotlight.

Tailoring Your Plan for Key Readers

The length, focus, and even the tone of your business plan need to change depending on who's reading it. A loan officer is paid to worry about risk, while an investor is hunting for massive growth.

Let’s break down how to adjust your plan for two of the most common audiences for a small business:

-

For the Bank Loan Officer: Their one big question is, "Will we get our money back?" Your plan needs to scream financial stability. Get into the weeds with your cash flow projections, detail your collateral, and show exactly how you'll use every dollar of the loan. This is the place for conservative numbers and proof you've thought through the worst-case scenarios.

-

For the Venture Capitalist (VC): Their question is totally different: "Can this business give me a 10x return?" Here, your focus needs to be on the scalability of your business model and how you're going to shake up the market. Emphasize the massive market opportunity, your "secret sauce" or competitive advantage, and why your team is the one to pull it off. Your financials should be bold, but they must be anchored in solid research.

The core data doesn't change, but the story you tell with it does. For a bank, the story is about security and reliability. For an investor, it’s all about explosive growth and opportunity.

Introducing the Lean Business Plan

Sometimes, a 30-page document is just overkill. For internal strategy meetings or testing an idea with a potential partner, the Lean Plan is your best friend. This is essentially a one-page business plan that boils your entire strategy down to its absolute essentials.

It’s a fantastic way for a solo entrepreneur to get straight to the point without drowning an audience in details. The exercise of creating one is also incredibly valuable—it forces you to get crystal clear on what really drives your business model.

For small business owners just starting out, our GrowthGrid Starter Pack gives you the templates you need to build both a lean plan and a more detailed version without starting from a blank page.

A Few Lingering Questions

Even with the guidelines we've covered, a few common questions always seem to pop up for small business owners. Let's tackle them head-on so you can move forward with confidence.

Can a One-Page Business Plan Actually Get You Funded?

In a word? No. A one-page plan, or what many call a Lean Plan, is a fantastic starting point for an entrepreneur. It’s perfect for crystallizing your thoughts and pitching your idea in a casual setting.

Think of it like an elevator pitch on paper. It’s designed to pique interest, not to close the deal. Any serious lender or investor will need to see the full story—the detailed, traditional plan with a solid marketing plan and financial projections—before they’ll even consider cutting a check.

Does the Appendix Count Towards the Page Limit?

Nope, it doesn’t. And you should absolutely have one. The appendix is your secret weapon for keeping the main body of your plan lean and focused.

This is where you stash all the supporting evidence: team resumes, detailed financial tables, product mockups, permits, and market research charts. It keeps your core narrative clean and readable, landing you squarely in that sweet spot of 15-25 pages.

The appendix lets interested parties dig deeper without bogging down your primary message. It’s there if they need it, but out of the way if they don’t.

How Often Should I Dust Off and Update My Plan?

Your business plan isn't a "set it and forget it" kind of document. It’s a living, breathing guide for your small business. Plan on giving it a thorough review at least once a year.

You’ll also want to update it whenever something big happens. This could be anything from:

- Launching a major new product.

- Going after another round of funding.

- Making a big pivot in your marketing plan.

- Expanding into a new city or state.

As your business grows, your plan should grow right along with it. It’s your strategic roadmap, and you need to make sure it’s always pointing you in the right direction.

Ready to create a business plan that tells a compelling story without all the guesswork? At GrowthGrid, our AI-powered platform helps entrepreneurs and small businesses generate a complete, professional business plan in under 15 minutes. Start building your roadmap to success today at https://growth-grid.ai.