So, you're ready to write a business plan for your small business. It's more than just a document; it's the blueprint for your entire venture. It’s where you define your vision, dig deep into your market, lay out your marketing plan, and, of course, crunch the numbers. For a small entrepreneur, this is your strategic roadmap, whether you're trying to get a small business loan or just need to bring clarity to your path forward.

Your Quick Guide to Writing a Business Plan

Feeling a bit overwhelmed by the whole idea? Don't be. Let's reframe this: a business plan isn't some stuffy, formal report you write once and forget. It's a living guide for your small business—the tool that turns a brilliant idea into a real, actionable strategy.

For any small entrepreneur starting out, this process is invaluable. It forces you to get brutally honest about every part of your venture. You'll spot potential roadblocks before they hit, nail down exactly what makes your business model different, and get a clear picture of the resources you actually need. When you walk into a bank or a meeting with a potential partner, a solid plan is your most convincing argument that your business is built to last.

The Core Components of a Strong Small Business Plan

Every great business plan, from a one-person consultancy to a neighborhood bakery, is built on the same foundational pillars. Once you understand these sections, you'll know how to assemble a plan that truly works. They all fit together to tell the complete, compelling story of your small business.

- Executive Summary: This is your elevator pitch on paper—a quick, powerful overview of your entire plan designed to hook the reader from the first sentence.

- Company Description: Here's where you detail your mission, vision, legal structure (like sole proprietor or LLC), and the core of what makes your small business special.

- Market Analysis: This section proves you've done your homework on the local industry, your ideal customers, and the competition.

- Products and Services: A clear, straightforward explanation of what you're selling and the value it brings to your customers.

- Marketing and Sales Plan: Your strategy for how you’ll reach, win over, and keep your local customers coming back.

- Financial Projections: The numbers that back everything up. This is where you lay out your realistic forecasts for revenue, expenses, and profitability.

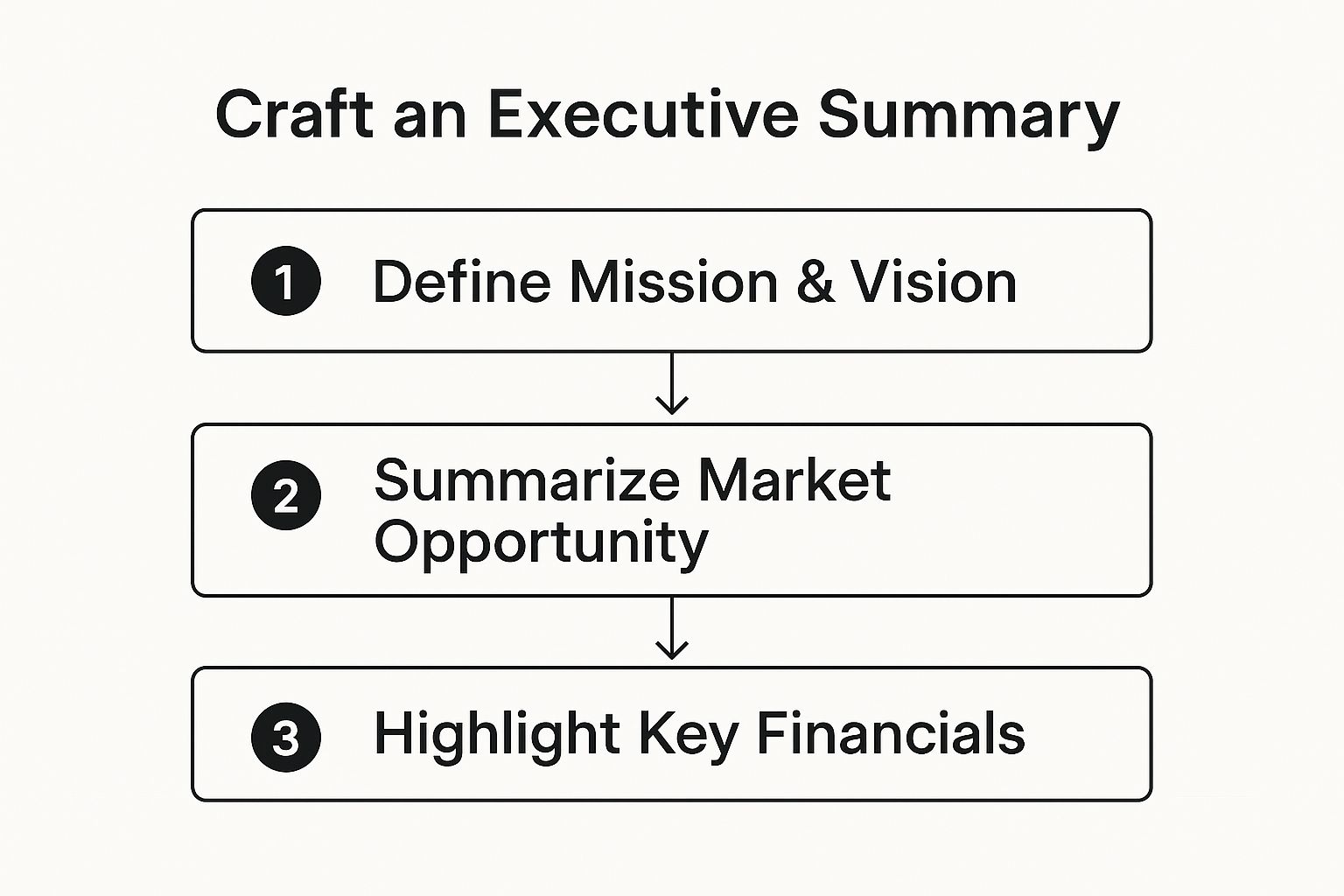

To help you get started on the right foot, let's look at the flow of an effective business plan. This is your chance to make a strong first impression.

As you can see, a powerful summary begins with your core mission. From there, you connect it directly to a tangible market opportunity and back it all up with your most important financial highlights. This logical flow creates a convincing narrative right from the start, making anyone who reads it eager to learn more about your small business model.

To give you a better sense of how these pieces fit together and the effort involved, here’s a quick breakdown for a small entrepreneur.

Key Business Plan Components at a Glance

| Component | Key Focus | Estimated Time |

|---|---|---|

| Executive Summary | A concise, compelling overview of the entire plan. | 2-4 hours |

| Company Description | Defining your mission, vision, legal structure, and unique advantages. | 3-5 hours |

| Market Analysis | In-depth research on your industry, target audience, and competitors. | 10-15 hours |

| Products & Services | Clearly detailing what you sell and its value proposition. | 4-6 hours |

| Marketing & Sales | Outlining your strategy to attract and retain customers. | 8-12 hours |

| Financial Projections | Creating realistic forecasts for revenue, expenses, and profitability. | 15-20 hours |

Remember, these time estimates are just a guide. The most important thing is to be thorough and create a plan that you can actually use to build and grow your small business.

Defining Your Core Business Vision

Before you even think about crunching numbers or analyzing market data, your business plan needs a soul. This is where you lay out your "why"—the core purpose that gets you out of bed in the morning. For a small entrepreneur, this passion is your greatest asset. Think of it as the North Star for every single decision you'll make.

Don't mistake this for a fluffy, feel-good exercise. The data is clear: entrepreneurs who actually take the time to write a detailed business plan are a staggering 152% more likely to get their business off the ground. What's more, those with a formal plan grow 30% faster than those flying by the seat of their pants. You can dig into more of these business plan statistics to see just how much planning pays off.

From Passion to a Powerful Mission Statement

Your mission statement is your rally cry. It’s a short, memorable, and powerful sentence that spells out what you do, who you do it for, and what makes you different. Steer clear of empty jargon like "being the best." Instead, focus on the real, tangible impact you want to make as a small business.

Let's take a small, independent coffee shop. A generic mission might be "to serve great coffee." That’s forgettable. A much better one? "To create a welcoming neighborhood hub where our community connects over ethically sourced, expertly roasted coffee." See the difference? The second one instantly paints a picture of the shop's values and business model.

Pro Tip: A good mission statement should be easy enough for your whole team to remember and repeat. If they can't recall it, it's not doing its job. This is the bedrock of your company culture, even if your team is just you.

Crafting Your Unique Value Proposition

This is the heart of your competitive edge. Your unique value proposition (UVP) is a crystal-clear statement explaining how you solve a customer's problem and why your small business is the best choice. It’s the direct answer to the question, "Why should I buy from you and not the other guys?"

To really nail your UVP, you need to zero in on a few things:

- Your Target Customer: Who, exactly, are you helping? Get specific about their frustrations and what they truly want.

- The Problem You Solve: What specific headache does your product or service cure for them?

- Your Secret Sauce: What makes your solution stand out? For a small business, this could be personalized service, unique local expertise, or an amazing customer experience.

For instance, a freelance graphic designer’s UVP isn’t just "I make logos." It could be: "We deliver budget-friendly, high-quality branding packages for startups in under a week, so new entrepreneurs can launch professionally without breaking the bank." This clearly names the customer (startups), their problem (tight budget and timeline), and the unique solution (speed and affordability).

The Executive Summary: Your First and Only Impression

Here’s a little secret: even though the executive summary sits at the very front of your business plan, you should always write it last. Think of it as a high-level preview of your entire document, designed to hook the reader and make them eager to learn more. If you're looking for a small business loan, this is arguably the most important page you'll write.

Your executive summary needs to be a compelling, concise snapshot of your business. It should briefly hit on:

- Your mission and vision

- A quick description of your products or services

- A summary of your market analysis and who you're selling to

- Your competitive advantages

- A highlight of your key financial projections

- Your funding request, if you have one

It’s the movie trailer for your business. It has to be exciting and clear, leaving the reader wanting to see the whole film. A sharp executive summary immediately signals that you're a professional who has a clear vision and a real strategy to bring it to life.

Conducting Your Market and Competitor Analysis

A brilliant idea is only as strong as the market it serves. This is the section of your business plan where you get to prove, with real-world evidence, that people actually want what you're selling. For a small entrepreneur, this analysis is your reality check, ensuring your business model is grounded in genuine customer demand.

This analysis is absolutely crucial. Consider this: roughly 20% of adults worldwide are involved in some kind of entrepreneurial activity. That's a staggering number, somewhere between 582 and 665 million people. With the startup world growing at about 21% each year globally, you need sharp market insights to find your footing. For a deeper look, check out this breakdown of entrepreneurship statistics.

The global entrepreneurial landscape is diverse and dynamic. Understanding where the growth is happening can provide context for your own market ambitions.

Entrepreneurial Growth by Region

Here's a quick look at how entrepreneurial participation and growth rates vary across different parts of a global region.

| Region | Growth Rate |

|---|---|

| Metro | 25% |

| Suburbs | 18% |

| Rural | 12% |

These figures show that while metropolitan areas often see the most explosive growth, there are significant opportunities everywhere. Your analysis should pinpoint the specific dynamics of your chosen local market, whether it's a bustling city center or a quiet suburban town.

Identifying Your Ideal Customer

Before you can make a single sale, you have to know exactly who you're talking to. Vague descriptions like "millennials" or "small businesses" are far too broad to be useful. As a small entrepreneur, you need to get granular and build a crystal-clear picture of your ideal customer.

Let's imagine you're launching a meal prep delivery service for your local area. Instead of targeting "busy people," you'd zero in on "single, health-conscious professionals in our town, aged 25-40, who work over 50 hours a week and value convenience over cooking." Now that's a target. This detail will inform your entire marketing plan, from flyers to social media posts.

A deep understanding of your customer's pain points is your greatest competitive advantage. When you can articulate their problem better than they can, they'll automatically assume you have the best solution.

This initial research is foundational. For a more structured approach, you can explore the steps involved in a formal feasibility study for your business idea, which always starts with defining your target audience.

Sizing Up the Competition

Looking at your competitors isn't about getting intimidated; it's about spotting opportunities. Your mission is to find their weaknesses and identify the gaps in the local market that your small business can slip right into. Don't just glance at their products—dissect their entire customer experience.

- Direct Competitors: These are the obvious ones, the businesses offering something very similar to you, to the same people. If you're opening a local coffee shop, it's the other cafe just down the street.

- Indirect Competitors: These businesses solve the same core problem but with a totally different product. For that coffee shop, an indirect competitor could be the McDonald's on the corner slinging fast, cheap coffee or even the local grocery store selling premium beans for people to brew at home.

I always recommend creating a simple competitor matrix. Just a basic spreadsheet where you compare everyone on key factors like pricing, customer reviews, marketing channels, and what makes them special. If you notice all your local competitors are slammed for poor service, you’ve just found your opening. Make outstanding customer service a cornerstone of your business model, and you'll carve out a niche.

Analyzing Industry Trends and Opportunities

Finally, your analysis needs to lift its gaze from the present and look toward the horizon. What major shifts are shaping your industry? For a small business owner, this isn't about paying for expensive trend reports—it’s about being observant.

Are your local customers becoming more eco-conscious? Is there a growing movement to "buy local"? Are new apps or platforms making certain services easier to access?

Tuning into these trends helps you position your business for where the market is going, not just where it is today. For example, a local artisan who sees a rising demand for sustainable goods could start highlighting their use of recycled materials. Suddenly, an industry trend becomes a powerful part of your marketing plan and a direct advantage.

Structuring Your Products, Services, and Operations

https://www.youtube.com/embed/MQAQ_y3x_DE

You’ve nailed down your vision and sized up the competition. Now it's time to get into the mechanics of your small business. This is where you connect your grand ideas to the ground floor, detailing exactly what you’re going to sell and how you’re going to deliver it.

Think of this section as the practical heart of your business plan. It’s where you prove that your business model isn't just a great idea but a well-oiled machine ready to run. You’ll cover everything from your core offerings and pricing to the daily operations, showing potential lenders you’ve thought through every single step.

Defining Your Core Offerings

First things first: what are you actually selling? List out every single product or service you'll offer. But don't just stop at a name. Explain the key features and, more importantly, the benefits they deliver. How do you solve your customer’s problem better than anyone else?

This clarity is make-or-break for a new entrepreneur. A local bakery, for example, isn’t just selling "bread." A much better description would be, "Artisanal sourdough bread made with locally milled organic flour, perfect for health-conscious families seeking high-quality, preservative-free options." That detail immediately communicates value.

The Small Business Administration (SBA) provides fantastic resources for small entrepreneurs. Their templates often prompt you to focus on the problem you're solving and what makes you different, which is exactly where your head should be.

Following a structure like this forces you to stay laser-focused on what truly matters to your customers.

Mapping Out Your Daily Operations

Now, let's talk about the "how." Your operational plan is the playbook for your daily business activities. For a small business, this plan has to be lean, efficient, and built to grow.

A solid operational plan should hit a few key points:

- Suppliers and Supply Chain: Where are you getting your materials? List your main suppliers and have backups. For a small business, a single supplier issue can halt everything.

- Technology and Tools: What software and equipment do you need? This could be anything from a Square POS system and QuickBooks for accounting to the specific tools of your trade.

- Staffing Plan: Who is doing what? Even if it's just you to start, outline the key roles. This shows you're thinking about how the business will function and how you'll expand when the time is right.

A well-defined operational plan is a sign of a mature business model. It shows you've moved beyond the "idea" phase and are ready to execute with precision.

Let's bring this to life with an example. A small coffee shop's plan would detail its relationship with a local roaster, specify the espresso machine it uses, and lay out the daily staffing schedule for baristas.

You can see all these pieces come together in a sample coffee shop business plan to get a feel for the complete picture. This level of detail builds massive confidence, proving your small business isn't just profitable on paper—it's built to thrive in the real world.

Building Your Marketing and Sales Strategy

A fantastic product is a great start, but if nobody knows it exists, it might as well be invisible. This is where your marketing plan comes into play. It's the engine that turns your brilliant idea into actual revenue. This section of your business plan is the practical, step-by-step playbook for how you’ll get noticed and make sales as a small business.

Don't treat this as a box-ticking exercise. While the global small business market is enormous—valued at $2.57 trillion and projected to double by 2032—the reality on the ground is tough. Roughly half of all new businesses don't make it past the five-year mark. A top reason they fail? A weak marketing plan. A solid strategy is your best insurance policy against becoming another statistic. You can see a deep dive into small business statistics that really drives this point home.

Positioning Your Brand Effectively

Before you spend a single dollar on ads, you need to be crystal clear on your brand positioning. This is simply the unique space you want to own inside your customer's mind. For a small business, you can't be everything to everyone. Are you the cheapest option, the most luxurious, the fastest, or the most eco-friendly? This core idea will guide every part of your marketing plan.

For example, a pet-sitting service could position itself as "the go-to caregiver for anxious pets in our community." That’s specific. It immediately sets them apart from the generic dog-walking apps. This single idea would then shape everything from the calming colors on their website to their reassuring social media posts.

Your marketing plan isn't just about getting seen; it's about being remembered for the right reasons. A clear positioning statement acts as your compass, ensuring all your marketing efforts point in the same direction.

Choosing Your Marketing Channels

As a small entrepreneur, your resources are limited. You can't be everywhere at once. The smarter move is to be surgical. Your market analysis should have shown you where your ideal local customers hang out. Now, it's time to pick the marketing channels that give you a direct line to them.

Here are a few channels that consistently work for small businesses:

- Content Marketing: Create genuinely helpful content—think blog posts or short videos—that solves a problem for your audience. A local accountant could write a blog series on "Tax Tips for Small Business Owners," building trust and attracting the right kind of clients.

- Social Media Marketing: Don't spread yourself thin. Pick one or two platforms where your local audience is most engaged. A business selling handmade jewelry will likely get the most traction on a visual platform like Instagram or a local Facebook group.

- Email Marketing: Building an email list is like having a direct line to people who are interested in your small business. Offer a discount or a free guide to get people to sign up.

- Local SEO: If you have a physical location or serve a specific area, this is non-negotiable. It means getting your Google Business Profile in order and ensuring your website mentions your service area. When someone nearby searches for what you do, you want to be the first name they see.

Outlining Your Sales Process

So, you’ve grabbed someone's attention. Now what? How do you guide them from being a curious onlooker to a happy, paying customer? That journey is your sales process. For a small business, it doesn't need to be complex.

A straightforward sales process might look something like this:

- Awareness: A potential customer sees your sign, finds you on Google Maps, or hears about you from a friend.

- Interest: They visit your website or social media page to learn more.

- Consideration: They call for a quote or come into your store.

- Conversion: They make a purchase.

Mapping this out shows you have a repeatable system for bringing in customers. For instance, a home organizer could detail her plan to land her first 10 clients by networking in local parenting groups, offering a first-timer discount, and asking for referrals after every job. This shows you’re thinking practically about how to build momentum and generate that all-important initial revenue.

Forecasting Your Financials and Funding Needs

This is where your big idea gets a reality check. A brilliant business model and a slick marketing plan are fantastic, but if the numbers don't work, the business won't either. Your financial section translates all your hard work into the language that bankers and lenders understand best: money.

For a small entrepreneur, this section proves your business can actually make a profit. You need to present a clear, logical case that your venture is financially sound. This is what separates a passion project from a viable business.

Building Your Financial Projections

For many small business owners, staring at a blank spreadsheet is the most daunting part of this process. But it all boils down to a few key documents that paint a picture of your company's financial future. You'll want to project these out for at least three years, with your first year broken down month by month.

- Sales Forecast: This is your best-educated guess on future revenue. Ground it in your market research. For a boutique coffee shop, your forecast might be based on projected daily foot traffic, an average sale of $7.50 per customer, and a conservative estimate of how many of those people you can convert into customers.

- Expense Budget: List out everything you'll have to pay for. This includes your fixed costs—like rent, insurance, and software subscriptions—and your variable costs, which change with your sales, like coffee beans and cups.

- Cash Flow Statement: This might be the single most important document for a small business. It tracks the actual cash moving in and out of your bank account. A business can be profitable on paper but fail because it runs out of cash. This statement helps you spot potential shortfalls before they become a crisis.

Your financial projections aren't created in a vacuum. They are the direct result of every other section in your plan. The budget you set in your marketing plan should directly support the numbers in your sales forecast.

The Break-Even Analysis

A break-even analysis is a simple but incredibly powerful calculation. It tells you the exact sales volume you need to hit for your revenues to equal your total costs. In other words, it’s the point where your small business officially stops losing money.

Knowing this number is a game-changer. It gives you a concrete, measurable target. For an e-commerce store selling handmade goods, this analysis would show exactly how many items they need to sell per month to cover the cost of materials, workshop rent, and website fees. It’s a clear benchmark for success.

Securing Funding for Your Venture

If you’re looking for a small business loan to get off the ground, this is your formal "ask." Having solid financial projections gives you the justification for the amount you need. Be direct and transparent.

Make sure you clearly state:

- Exactly How Much You Need: State the specific dollar amount you're seeking.

- How You'll Spend It: Break it down so they know you have a plan. For example: $20,000 for initial inventory, $15,000 for equipment, and $10,000 for a three-month grand opening marketing campaign.

- What Kind of Funding You Want: Are you looking for a traditional small business loan? A line of credit? Be clear about what you need and why.

Common Business Plan Questions Answered

When you sit down to write a business plan, the questions start piling up. It's totally normal. As an entrepreneur, you want to get it right. Let's clear up some of the most common questions small business owners ask.

How Long Should My Business Plan Be?

There's no magic number, but a good rule of thumb for a traditional plan—the kind you’d show a banker—is somewhere between 20 and 40 pages. This gives you enough space to detail your market research and financials without being overwhelming.

But if you're creating a "lean" plan just for yourself to guide your strategy, you can get it all down in a few pages. The most important thing is to focus on clarity and actionable steps for your small business.

Do I Need Different Versions for Different Audiences?

Yes, and this is a game-changer for entrepreneurs. Your core business model and data won't change, but what you highlight will.

- For Bankers: They care about managing risk and want to know, "Can you pay back this loan?" You'll want to put your cash flow projections, collateral, and repayment plan front and center. Show them stability.

- For Investors (if applicable): They’re looking for growth potential. For them, you'll emphasize the size of the market opportunity, what makes your business model unique, and your vision for scaling.

Here's the key takeaway: Have one master business plan, but create custom-tailored summaries for each audience. It shows you’ve done your homework and understand what matters to them.

How Often Should I Update My Business Plan?

Please don't write your business plan and then let it gather dust in a drawer. It's a living document—your strategic roadmap. For a new small business, a quarterly check-in is a great idea. This is your chance to see what's working and adjust your marketing and financial forecasts based on real data.

For a more established small business, an annual review is usually enough. It’s the perfect time to review your goals and set new ones. That said, any major event—like a new competitor or a change in your market—should trigger an immediate update. For more answers to your business questions, check out our comprehensive FAQ section, which covers a ton of topics for entrepreneurs.

Is It Okay to Use a Template?

Of course! A template is a fantastic starting point for any entrepreneur. It gives you a professional structure and makes sure you don't miss any critical sections, like your marketing plan or financials.

But remember, a template is just the skeleton. It’s your job to bring it to life with your own research, your specific numbers, and your genuine passion for your small business. The template provides the framework, but your vision gives it a soul.