A solid market analysis is the single most important piece of research you'll do for your business plan. It’s not just a box to check; it’s the proof that your great idea can actually thrive in the real world. This is where you, the small business owner, show that you genuinely understand your future customers, your industry, and the other players on the field. Everything else—your business model, your marketing plan—is built right on top of this foundation.

Why Your Business Plan Starts with Market Analysis

For most small entrepreneurs, an idea starts with a spark of passion. Maybe it's a family recipe, a clever service you know people need, or a unique product you started making by hand. But passion alone doesn't guarantee success. A detailed market analysis for a business plan is what turns that personal project into a strategic, fundable small business. It answers the one question that matters most: who is going to buy this, and why?

Think of your business plan as the architectural blueprint for your new venture. If that’s the case, the market analysis is the land survey and soil report you run before you even dream of pouring the foundation. It tells you whether you're building on solid ground or sinking sand.

Connecting Analysis to Strategy

A huge mistake I see small entrepreneurs make is treating their market analysis like a standalone chapter stuffed with charts and data. The real magic happens when you let your findings directly shape your business model and marketing plan. The insights you uncover should be the driving force behind your most critical decisions.

-

Industry Trends: Are you stepping into a market that's growing or one that's shrinking? For a small business, grasping the bigger picture—like the consumer shift toward sustainable goods or the explosion of subscription-based services—helps you build a business model for the long haul, not just for right now.

-

Target Customer Profiles: Who are you really selling to? You need to go way beyond basic demographics like age and location. What are their biggest frustrations? What truly motivates them to make a purchase? Knowing this lets you create a product and a marketing plan that connects on a much deeper level.

-

Competitive Landscape: Who’s already out there? Sizing up your rivals' strengths is smart, but pinpointing their weaknesses is where the real opportunities are for a small business. Every gap in the market is an opening for you to offer something better, different, or more specialized.

For a small business, market analysis isn’t about trying to outspend the big guys. It’s about outsmarting them. You do that by finding a niche they've overlooked and then serving that niche better than anyone else.

A Real-World Scenario: The Artisan Bakery

Let’s say you want to open a local artisan bakery. A good market analysis goes way beyond just "people in my town who like bread."

It would uncover crucial details. Is there a surge in demand for gluten-free options in your specific neighborhood? Is the nearby farmers' market the go-to spot for locals every Saturday morning? Does the biggest bakery in town have a string of terrible online reviews complaining about their rude staff?

Each one of these nuggets of information directly shapes your business plan. The demand for gluten-free goods influences your menu. The popular market suggests a pop-up stall could be a great weekend marketing strategy. The competitor's poor service reveals an opportunity to win over their unhappy customers with an amazing experience. This kind of detailed research is also a key part of any formal feasibility study, which helps you really stress-test your venture's potential.

The value of this kind of deep research is no secret. Just look at the market research industry itself, which saw explosive growth in North America, jumping from $19.45 billion in 2015 to an incredible $62.64 billion by 2021. According to data from Scoop.market.us, this massive expansion just goes to show how essential deep market knowledge has become for building a business that lasts.

Mapping Your Industry Landscape

Before you can zero in on your ideal customer, you first need to get the lay of the land. Think of this as studying the game board before you make your first move. It’s about getting a clear, honest picture of the overall health, direction, and unwritten rules of the industry you're stepping into. This big-picture view is a cornerstone of any solid market analysis for your business plan.

For a small business owner, this part can feel like a mountain to climb. But you don't need to get buried in dense academic reports. The goal is to gather practical intelligence that actually helps you make smarter decisions for your business model.

Let's say you're launching a new line of eco-friendly cleaning products from your kitchen. Your industry isn't just "cleaning." It's the dynamic space where household goods, sustainability, and direct-to-consumer retail all meet.

Gauging the Market Size and Health

The first question any lender—or even you, yourself—should ask is: just how big is this opportunity? You need to find real numbers that define your industry's size and growth. Is it a booming field attracting new customers daily, a stable and mature market, or a sector that's slowly fading?

This tells you whether you're fishing in a tiny pond or a vast ocean. For our eco-friendly cleaning brand, we'd want to know the total annual spending on household cleaning supplies and, more specifically, the growth rate of the "green" product segment within that market.

My two cents for small entrepreneurs: This isn't just about impressing a bank. It's for you. Knowing the market size helps you set sales goals that are ambitious but realistic. It makes sure your entire business model is built on actual demand, not just wishful thinking.

This is all about putting a number on the potential. Look at the apparel industry—the global market was valued at around $1.84 trillion in 2025, a massive slice of the world's GDP. Even after a major dip in 2020, it bounced back and is projected to hit $2 trillion by 2028. Numbers like these, which you can explore in these global apparel industry statistics on UniformMarket.com, show the sheer scale you’re dealing with.

To get started on your own industry deep-dive, here’s a checklist of key metrics you’ll want to track down.

Key Industry Data Points to Collect

| Data Point | Why It Matters for a Small Business | Where to Find It (Examples) |

|---|---|---|

| Total Market Size (TAM, SAM, SOM) | Helps you quantify the overall opportunity and set realistic revenue targets for your business plan. | Market research reports (e.g., IBISWorld, Statista), government statistics, industry association publications. |

| Market Growth Rate (CAGR) | Shows if the industry is expanding, stagnant, or shrinking. A growing market is easier to enter. | Financial news outlets (Bloomberg, Reuters), investor presentations from public companies in your space. |

| Profitability & Key Financial Ratios | Gives you a benchmark for what's considered healthy financial performance in your sector. | Industry financial reports, business journals, financial data providers. |

| Number of Businesses / Competitors | Indicates market saturation. A high number might mean intense competition. | Business directories, census data, local chamber of commerce reports. |

| Key Segments & Niches | Helps you identify underserved areas or specific customer groups to target for your marketing plan. | Trade publications, competitor analysis, consumer surveys. |

Having these figures in hand gives your business plan a foundation of fact, not fiction, and shows you've done your homework.

Identifying Key Industry Trends

Beyond the raw numbers, you need to understand the currents shaping your industry's future. These are the powerful forces—driven by technology, consumer behavior, or new regulations—that can either lift your small business up or leave it in the dust.

For our eco-friendly cleaning brand, the big trends are impossible to ignore:

- Sustainability Demands: Consumers are actively seeking out plastic-free packaging, refillable containers, and non-toxic ingredients. This is no longer a niche preference.

- The DTC Shift: More and more small brands are skipping traditional retail and selling directly to customers online, allowing them to own the customer relationship.

- Ingredient Transparency: People want to know exactly what's in the products they use in their homes. Vague labels are a major turn-off.

Catching these trends early lets you build a business that feels fresh and relevant. You're not just positioning your product for today, but for where the market is headed tomorrow.

Understanding the Economic Environment

Finally, zoom out and look at the broader economic factors at play. These are things you can't control—like inflation, consumer spending habits, or supply chain hiccups—but you absolutely have to acknowledge them in your business plan.

For a new entrepreneur launching a product, this means asking tough questions. Are people splurging on premium goods right now, or are they pinching pennies and hunting for value? What are the risks of your raw material costs suddenly spiking?

Acknowledging these realities in your business plan doesn't show weakness; it shows you have a grounded, realistic view of the world. It proves you're ready for the challenges, not just the opportunities, and that makes your entire plan far more credible.

Who Are You Really Selling To?

I’ve seen it a thousand times: a new entrepreneur, beaming with passion, tells me their target market is "everyone." While the enthusiasm is great, that one answer is the single biggest red flag in a business plan. It's the fastest way to burn through your cash and get completely lost in the noise.

A killer market analysis for a business plan doesn't start with your product; it starts with a laser-focused understanding of your customer. You need to know them so intimately that your product, your messaging, and your entire marketing plan feel like they were created just for them.

This goes way beyond basic demographics like age and gender. The real gold is in the psychographics—their values, their fears, their habits, and what keeps them up at night. That's what drives a purchase.

Let's say you're a freelance graphic designer starting your own small business. Just saying you serve "small businesses" is far too vague. To build a truly successful business, you have to slice that market into much smaller, more defined groups.

From a Wide Net to a Sharp Spear

This process is called market segmentation. It’s all about breaking down a huge, generic market into manageable groups of people who share common needs and characteristics. For our designer, those segments could look wildly different:

- Bootstrapped Tech Startups: These folks are scrappy and innovative but operate on a shoestring budget. They need work done fast and want a modern look, but they’ll balk at a high-end branding package.

- Established Local Restaurants: These owners value tradition, reliability, and someone who gets the local vibe. They likely have a more stable budget and need a designer who can deliver a classic, professional feel.

- Solo Wellness Coaches: This group is all about building an emotional connection and a personal brand. They need designs that feel authentic, inspiring, and work beautifully on social media.

See the difference? By segmenting the market, our freelance designer can stop trying to be everything to everyone. They can pick the group that best fits their skills and business model, then tailor their entire marketing plan to winning them over.

Bring Your Ideal Customer to Life

Once you've zeroed in on your best segment, it's time to build a customer persona. This is a fictional character who embodies your ideal client. Give them a name, a job, a backstory—make them real. This simple exercise is incredibly powerful because it forces you to think and talk about a person, not a demographic.

Let's stick with our designer, who has decided to focus on local restaurants. They might create a persona like "Brenda, the Overwhelmed Restaurateur."

Brenda, The Overwhelmed Restaurateur

Brenda is 45 and runs the beloved Italian restaurant her parents started. She's a whirlwind of activity, managing staff, ordering inventory, and greeting regulars. She knows her menus look dated and her Instagram is a ghost town, but she simply has no time. Her biggest frustration is feeling stuck in the past. She's looking for a designer who is reliable, "gets" her vision without endless meetings, and can deliver a quality look that honors her family's legacy.

Suddenly, every marketing decision gets crystal clear. You're no longer just selling "graphic design services"; you're offering Brenda a way to modernize her legacy without adding to her stress.

For a completely different business, like an online pet supply store, your persona might be a Millennial dog owner who obsesses over organic ingredients. You can see a great example of this fleshed out in our sample business plan for an online dog food company.

Ditch the Guesswork and Find Real Insights

A persona is only as good as the data behind it. As a small entrepreneur, you don't need a massive research budget; you just need to be a little clever.

- Become a Fly on the Wall: Join Facebook groups, Subreddits, and online forums where your ideal customers hang out. Pay attention to the language they use, the questions they ask, and the problems they complain about. This is unfiltered, raw insight for your marketing plan.

- Mine Competitor Reviews: Go read the 1-star and 5-star reviews for your competitors. The 5-star reviews tell you what people absolutely love. The 1-star reviews show you the exact gaps and frustrations you can solve.

- Launch Simple Surveys: Use a free tool like Google Forms to create a quick, 5-question survey. Ask about their biggest challenges related to your industry and what they wish existed.

These scrappy research methods give you the qualitative details needed to build a persona that isn't just a guess. You’ll start to see patterns. For instance, by 2025, the global influencer marketing market is projected to hit around $33 billion. This isn't just a random statistic; it tells you that people are putting immense trust in creators, especially on platforms like Instagram, which alone accounts for over $22 billion of that market. You can dig into this trend and others at Statista.com, where they track how brands are connecting with customers.

How Big is Your Pond?

Finally, you need to put some numbers to this opportunity. Lenders and potential partners want to see that you've done your homework and understand the real-world potential. This is where the TAM, SAM, and SOM model comes in handy.

- Total Addressable Market (TAM): This is the biggest possible pie—the total global demand for what you offer. For our designer, it's the entire world's spending on graphic design.

- Serviceable Available Market (SAM): This is the slice of the pie you can actually reach with your business model. For our designer, it might be all the small businesses in their country or city.

- Serviceable Obtainable Market (SOM): This is your realistic, short-term target. It's the piece of the SAM you can realistically capture, given your current resources and competition. This is the number that matters most in your business plan.

Walking through this exercise proves you have a grounded, strategic view of the market. It shows you're not just chasing a fantasy but have a clear plan to win a specific, profitable piece of the action.

Conducting Your Competitive Analysis

Let's be blunt: every business has competition. Even if your idea feels entirely new, customers are solving their problem somehow, and that's your competition. Pretending otherwise is a fast track to failure for any small entrepreneur.

A solid competitive analysis isn't about nervously watching your rivals or copying their every move. It's about becoming a strategist. You're systematically looking for their vulnerabilities—the gaps in their products, the flaws in their service, or the pricing that just doesn't sit right with customers. Every weakness you uncover is an open door for you to walk through and win over an underserved audience.

Direct vs. Indirect Competitors

First things first, you need to map out the entire competitive landscape. To do that, I always split rivals into two camps:

- Direct Competitors: These are the ones you think of immediately. They offer a nearly identical product or service to the same group of people.

- Indirect Competitors: This group is sneakier and often overlooked. They solve the same core customer problem, just with a different solution.

Imagine you're launching a gourmet food truck that specializes in artisanal tacos. Your direct competitors are easy to spot—other food trucks, especially those slinging tacos or similar Mexican fare.

But your indirect competition is much broader. Think about it from the customer's perspective. They want a quick, affordable lunch. That means you're also up against the cafe on the corner, the local Chipotle, and even the deli selling pre-made sandwiches. Ignoring them means ignoring a huge chunk of your potential market's options.

What to Analyze for Each Competitor

Once you've got your list, it's time to put on your detective hat. You need to dig deep and gather intel on a few key areas to truly understand how they operate.

- Their Product or Service: Don't just browse their website—buy their product. Experience their service firsthand. Is the quality top-notch or just okay? What are the standout features? More importantly, where does it fall short?

- Their Pricing Strategy: Are they the cheap option on the block, the premium choice, or floating somewhere in the middle? Look for patterns. Do they run constant sales? Do they push expensive upsells? This tells you a lot about how they position their value.

- Their Marketing and Sales Tactics: How are they getting the word out? Scrutinize their website, their social media feeds, and any ads you stumble across. Are they all-in on Instagram, or do they still rely on old-school local flyers? This shows you where they think their customers are spending time.

- Their Strengths and Weaknesses: Now, pull it all together. A major strength might be their prime real estate or a massive email list. A critical weakness could be a flood of bad online reviews complaining about slow service or a buggy, outdated website.

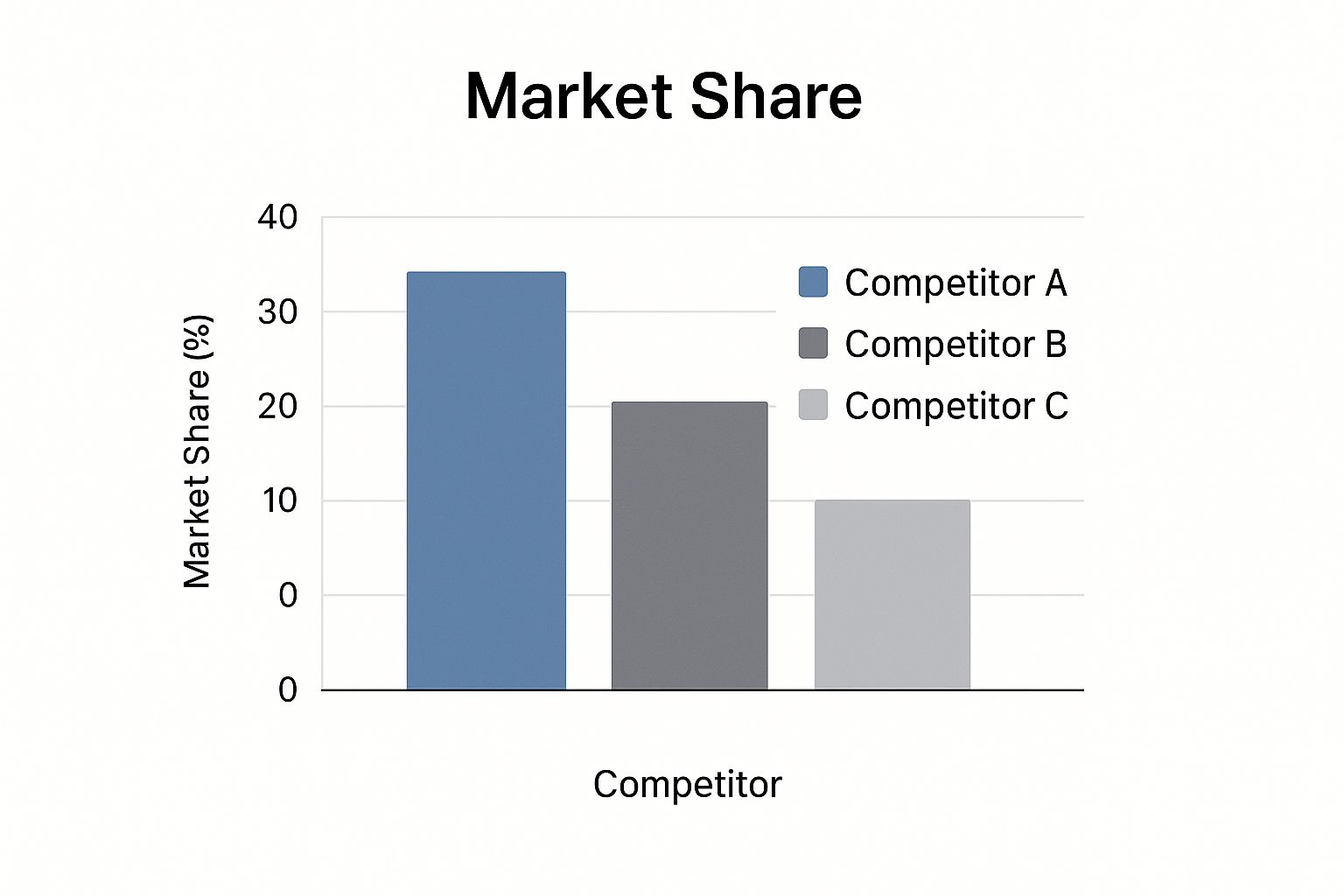

The chart below gives you a bird's-eye view of who the big players are in a given market, helping you visualize where the power lies.

Here, it's clear Competitor A is the leader. But with almost 50% of the market split among smaller players, there's obviously room for a small business to compete—it's not a monopoly.

Finding Your Unique Advantage

As you gather this intel, patterns will emerge. You'll start seeing the gaps. Maybe all the competing food trucks in your part of town close by 3 PM, completely ignoring the dinner rush. Or perhaps their online reviews are a chorus of complaints about the lack of decent vegetarian options.

These aren't just interesting facts; they are your opportunities. This is the raw material for your Unique Selling Proposition (USP)—that one compelling thing you offer that no one else can touch. This is how you stop competing on price and start competing on value.

A competitive matrix is the perfect tool for getting this all organized. It’s a simple chart that lets you see, at a glance, exactly how you stack up.

A clear matrix helps you visualize the competitive landscape and pinpoint your strategic advantages instantly.

Competitive Analysis Matrix Example

| Feature/Attribute | Your Business | Competitor A | Competitor B |

|---|---|---|---|

| Price Point | Mid-Range ($12-$15) | Low ($8-$10) | Mid-Range ($10-$14) |

| Vegetarian Options | Excellent (3 dedicated items) | Poor (1 item, uninspired) | Fair (2 basic items) |

| Service Speed | Excellent (Target <5 min) | Good | Poor (Long lines) |

| Marketing Focus | Instagram, Local Events | Facebook, Radio Ads | Word of Mouth Only |

| Key Weakness | New / No Reputation | Limited Menu Diversity | Inconsistent Hours |

Seeing it laid out like this makes your strategy crystal clear. You're going to win by owning the vegetarian crowd, emphasizing lightning-fast service for busy lunch-goers, and dominating Instagram with mouth-watering photos of your tacos. Your competitive analysis just handed you the playbook for your entire marketing plan.

Turning Your Research into a Killer SWOT Analysis

You've spent hours digging through industry reports, sketching out customer personas, and sizing up the competition. That's fantastic. But right now, all that valuable research is just a pile of data. It needs a purpose.

This is exactly where a SWOT analysis comes into play. It’s the bridge that turns your raw findings into a clear-eyed strategic roadmap for your small business.

Think of a SWOT analysis as a simple, powerful framework for organizing everything you've learned into four distinct buckets. This isn't just a box-ticking exercise for your business plan; it's a critical tool for making sense of the market you're about to enter. It forces you to separate things into two camps: internal factors (the stuff you can control) and external factors (the stuff you can't).

- Strengths: What are your internal advantages? What do you do better than anyone else?

- Weaknesses: Where are you vulnerable internally? What are your limitations?

- Opportunities: What external trends or market gaps can you jump on?

- Threats: What external forces could derail your business?

By laying everything out this way, you get a bird's-eye view of where you stand.

Looking in the Mirror: Internal Strengths and Weaknesses

Strengths and weaknesses are all about what’s happening inside your business. This is where you have to be brutally honest with yourself.

For a new entrepreneur, a strength might be that secret family recipe for the sauce you’re selling. It could be your 10+ years of industry experience or a fantastic, low-rent location with tons of foot traffic. These are your secret weapons.

On the other side of the coin, you have weaknesses. Maybe you have a tiny marketing budget compared to the big guys. Or perhaps your brand has zero recognition because you’re brand new. Maybe your entire operation relies on just one person (you!). Facing these realities head-on is the only way to build a plan that works.

Scanning the Horizon: External Opportunities and Threats

Opportunities and threats are dictated by the world outside your doors. All that industry, customer, and competitor research you did? This is where it pays off. You can't control these forces, but you sure as heck need to react to them.

An opportunity is a golden ticket. Say your research shows the leading local competitor has a boatload of terrible customer service reviews. That's a massive opportunity for you to swoop in and win over their unhappy customers. Another opportunity could be a growing consumer trend—like the demand for plant-based foods—that your product fits into perfectly.

Threats, of course, are the storm clouds. These could be rising ingredient costs that could crush your profit margins, a new competitor setting up shop a block away, or shifting government regulations that throw a wrench in your plans. Naming these threats doesn't mean you're doomed; it means you can start building a plan to navigate the storm.

The real magic of a SWOT analysis isn't just filling in the boxes. It's about connecting the dots. The best business plans show exactly how a small business will use its strengths to pounce on opportunities, shore up its weaknesses, and build a defense against threats.

Connecting the Dots to Build Your Strategy

With your SWOT grid filled out, the real work begins. You're shifting from analysis to action. The goal now is to ask strategic questions that link the quadrants together, forming the foundation of your business model and marketing plan.

- Strength-Opportunity (SO) Strategies: How will you use your strengths to capitalize on opportunities?

- Example: "We'll use our unique sauce recipe to target the growing trend of foodies seeking authentic, small-batch products."

- Weakness-Opportunity (WO) Strategies: How can you overcome your weaknesses by taking advantage of opportunities?

- Example: "To counter our limited budget, we'll focus on low-cost social media marketing, capitalizing on our competitor's weak online presence."

- Strength-Threat (ST) Strategies: How can your strengths help you fend off threats?

- Example: "We'll leverage our strong relationships with local suppliers to lock in prices, protecting us from the threat of rising ingredient costs."

- Weakness-Threat (WT) Strategies: How can you minimize your weaknesses to avoid getting hit by threats?

- Example: "To mitigate the threat of a new competitor, we will launch a loyalty program to retain early customers, offsetting our lack of brand recognition."

This final step is what transforms your market analysis for your business plan from a static document into a living, breathing strategy. It ensures every ounce of your research directly fuels the decisions that will make or break your business.

Common Questions About Market Analysis

https://www.youtube.com/embed/21b5QF-b0rE

Even with the best roadmap, diving into a market analysis for your business plan can feel a bit like navigating uncharted territory. Let's walk through some of the most common questions and roadblocks I see small entrepreneurs run into. These are the real-world, practical concerns that pop up time and time again.

How Much Should a Small Business Spend on Market Analysis?

This is the big one, and the answer usually comes as a relief: you don't need a massive budget. A huge mistake many entrepreneurs make is assuming they need to shell out thousands for expensive, off-the-shelf industry reports.

For most startups and small businesses, your most valuable investment is your own time and scrappiness. The most critical work—the stuff that really matters—can often be done with free or low-cost tools. Think about exploring Google Trends, digging into Census Bureau data, or using free survey tools like Google Forms.

The goal isn't to spend a lot of money; it's to get smart, specific answers to your most pressing questions. If you do set aside some cash, aim it at highly targeted needs—maybe a small focus group with your ideal customers or a subscription to a niche trade journal. A little bit of smart, DIY research will almost always beat expensive, generic data.

What Are the Biggest Mistakes Entrepreneurs Make?

Knowing the common pitfalls is half the battle. If you can sidestep these, your analysis will be infinitely more valuable and grounded in reality.

From what I've seen, here are the top mistakes small entrepreneurs make:

- Confirmation Bias: This is the most dangerous one. It's that natural human tendency to look for data that supports the idea you've already fallen in love with, while conveniently ignoring anything that pokes holes in it. You have to actively hunt for evidence that could prove you wrong.

- Defining the Market Too Broadly: Ah, the classic "everyone is my customer" trap. This leads directly to a weak, unfocused marketing plan because you can't possibly craft a message that resonates with a specific group's unique needs.

- Underestimating the Competition: So many entrepreneurs only look at their direct rivals—the businesses that look and feel just like theirs. They completely miss the indirect competitors who solve the same core problem for the customer, just in a different way.

- Treating It as a One-Time Task: Your market isn't a static photograph; it's a moving picture. Competitors evolve, customer tastes shift, and new trends pop up overnight. Your analysis needs to be a living document that you come back to and update regularly.

My Market Is Completely New. How Do I Analyze It?

When you're building something genuinely new, you can't just look up existing market data—it doesn't exist yet. Your job shifts from being a researcher to a data creator. You do this through a clever mix of smart analogies and hands-on primary research.

First, look for analogous markets. Who buys products or services that solve a similar type of problem, even if it's in a totally different industry? When ride-sharing apps first launched, they couldn't find data on ride-sharing. Instead, they analyzed the taxi and rental car industries to understand travel patterns and consumer spending habits.

Next, you have to lean heavily into primary research. This is where you, the small business owner, get out and talk to potential customers.

- Founder-Led Interviews: Have deep, one-on-one conversations. Don't pitch—listen.

- Lean Experiments: Throw up a simple landing page describing your solution and ask people to sign up for a waitlist. This is a fantastic, low-cost way to see if anyone actually wants what you're building.

- Surveys: Ask pointed questions about the problem you're trying to solve, not just your solution.

For a new market, you are the chief data creator. Your mission is to validate demand one conversation and one experiment at a time. If you have more questions about this process, you can explore our detailed guides and find answers in the GrowthGrid FAQ section.

How Do I Present Market Analysis in My Business Plan?

How you package your findings is just as important as the research itself. A messy pile of stats and charts won't impress a lender or potential partner. Your presentation has to be clear, concise, and—most importantly—it needs to tell a compelling story with your data.

Use charts and graphs to make your data easy to scan and understand. Visualize your key points, like market size, growth trends, and your competitive landscape. A simple bar chart is often far more powerful than a dense paragraph of text.

But here’s the most critical part: don't just present the numbers—explain what they mean for your business.

Instead of just stating, "The market is growing at 5% annually," you need to explain how your small business is uniquely positioned to capture a profitable slice of that growth. Use clear headings to guide the reader through your industry overview, target market, competitive analysis, and SWOT. This builds a logical and persuasive case that you’ve found a clear, defensible, and profitable place in the market.

Ready to transform your research into a powerful, professional business plan? GrowthGrid uses advanced AI to help you generate a complete, investor-ready plan in under 15 minutes. Stop staring at a blank page and start building your future. Create your personalized business plan today at https://growth-grid.ai.